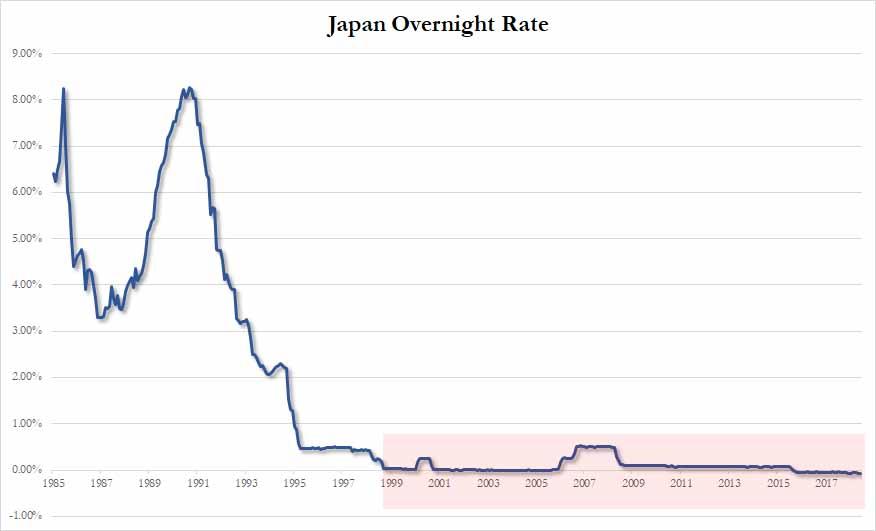

In the annals of modern central (bank) planning, today is a tragic day, or as DB's Jim Reid puts it, "it is a bit of a landmark anniversary of sorts for financial markets" - it’s the 20-year anniversary of the Bank of Japan cutting rates to 0% and the start of two decades of extreme monetary policy which neither Japan, nor any other country, has ever been able to escape from.

As Reid notes, this is a "sobering template for Europe to worry about" and adds that Japan also kick started what became a more mainstream form of monetary policy post the GFC around the world.

For economic historians Japan is really a fascinating case. If you took a snapshot of the nation’s finances and demographics today with no previous knowledge of the country’s journey over the last 30 years since its asset bubble burst, you would wonder how the country isn’t in a constant crisis. Debt to GDP is the highest in the developed world at 236%. The BoJ holds around 43% of all JGBs.

Core prices in Japan are also virtually identical to where they were 20 years ago and 10yr JGBs have fallen from 2.21% to -0.03% over this period. Nevertheless,

Japan is an example of how long a crisis can be averted for under extreme measures. It also highlights how perceptions can be turned on their heads.

Yesterday we found this quote from The Economist 20-years ago: "Without fiscal discipline, say Bank of Japan officials, the government risks losing control of public spending, inviting hyperinflation in the world's second-biggest economy."

Reid's conclusion: "an unhappy anniversary today in many respects but it’s also noticeable that after 20 years of high fiscal spending the Japanese don’t have populism. Maybe that’s a message for Europe."

via IFTTT