Guest Post by Eric Peters

Ass, gas or grass – no one rides for free. So said the once popular bumper sticker.

Unless you drive an EV.

Then you can use the government to force someone else to “help” pay for your ride – and your road. Because you don’t have to pay any of the gas taxes that fund the roads.

It’s quite a five-fingered discount, too.

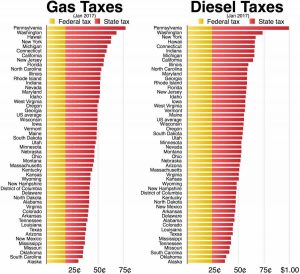

Gas taxes – federal and state – tally about 50 cents on average, added to the cost of every gallon of gasoline (and diesel) sold. If your car’s tank holds 15 gallons – which is typical – you’re paying about $7.50 in taxes every fill-up, regardless of the cost of the gas.

If you fill up twice a week, that’s about $30 per month – or $360 annually. Over the course of a six-year new car loan, the bite comes to $2,160.

Owners of vehicles with bigger tanks that use more gas pay more in taxes, obviously. If you have an SUV or pick-up with a 21 gallon tank, each fill-up costs you about $10 in motor fuels taxes, or $40 each month – $480 annually.

$2,880 over six years.

But EV owners don’t pay a red cent. This includes Ludicrous Speed energy hogs like the Tesla S – which burn up lots of untaxed electricity.

Which is why several states have begun sending them a separate bill for their use of the roads they’re not paying for.

It’s not much of a bill. In fact, it’s a lot less of a bill than the rest of us are paying (and not counting the other paying we’re doing . . . to “help” EV owners buy their car through subsidies and cost-shifting from unprofitable EVs to the profitable vehicles the rest of us buy but now pay just a bit more for, in order for EV owners to pay less for theirs).

Arkansas, for instance, recently passed a law that will require all EV owners to pay a $200 fee each year (added to the usual vehicle registration renewal fees) in lieu of paying at the pump. But it amounts to the same thing.

They’re being charged for what they use – just like the rest of us.

And it amounts to a discount, in relation to what the rest of us pay.

$200 annually is about half what the average non-electric car driver pays each year in motor fuels taxes.

But Consumer Reports think it’s too much – that any fees are too much – probably because expecting EV owners to pay for the roads they use will “discourage adoption” of electric vehicles.

This is true, of course.

Having to pay for something tends to cause most people to think twice about buying it. Or at least, to weight the costs vs. the benefits before they buy it.

The problem with electric cars is that the costs do outweigh the benefits.

Which is why it is so important to shove those costs under the rug, in order to take people’s minds off them – in order to wheedle them into buying what they otherwise probably wouldn’t.

This includes the cost to drive the EV.

The free lunch at the plug conjures the illusion that the EV owner is saving money vs. his neighbor – the one who was forced, through taxes, to “help” him buy his EV.

Or at least, it makes the EV owner feel a bit less stupid, financially, about spending thousands of dollars more on his EV. He tells himself he’ll recoup that loss in the form of what he’s not having to spend on fuel (and taxes).

But what happens when that free ride disappears?

When Denmark dialed back what it paid people to buy EVs, people stopped buying them almost completely. Sales plummeted by more than 60 percent in one year – not surprising since the end of the subsidy amounted to a sudden several thousand dollar increase in the cost of the EV.

The same thing happened in Hong Kong and everywhere else where prospective buyers were faced with having to pay full price for an electric car.

Most people would never buy an EV at full price for the simple reason that they can’t afford too – leaving aside the other problems. That’s why the government has to pay people to buy EVs.

Adding several thousand dollars to the cost of EV ownership in gas-tax-equivalent road-use taxes makes the math that much worse – which makes it that much harder to wheedle people into EVs.

Which is problem for those pushing EVs.

Like CR.

CR has, of course, never published a critical word about gas taxes, which it has always favored more of – but not to pay for the roads. Instead, to “nudge” American drivers out of the kinds of cars CR doesn’t like, such as pick-ups and SUVs.

But because CR wants to “nudge” Americans into electric cars, it opposes making them pay even a portion of what the rest of us pay.

And then lies about it.

Either that or the editors of CR are innumerate.

The magazine claims that EV fees being applied by states like Arkansas are “up to four times higher than the annual gasoline tax would be for the average new car in 2025.”

Italics added.

The scoundrels! They are basing their math on a nonexistent (as of 2019) “average new car” that averages almost 50 MPG – nearly double what the typical car you can actually buy today averages – on the assumption that a federal fatwa so mandating all new cars must average by 2025 becomes a legal requirement. (The Orange Man is fighting this; see here for more.)

But the only 2019 cars that average 50 MPG are compact-sized hybrids like the Toyota Prius, which constitute less than 5 percent of the total new car spectrum. Using hypothetical 2025 model years cars as the basis for its cost comparisons is a greasy shuck-and-jive that would make a tent show evangelist blush.

CR’s editors know perfectly well that there is quite a difference between what most people who don’t drive electric cars today are paying in motor fuels taxes vs. what it asserts they’ll be paying in 2025, when they assume the average new car will average 50 MPG.

What if it doesn’t?

And what if people don’t trade-in what they’re driving today for that “50 MPG” 2025 model?

CR is trying, in other words, to make it look as though EV owners are being hit up to pay more for the roads they use vs. what non-electric car owners actually are paying – when in fact, the mild fees a few states are imposing on EV owners are well below what most people are paying right now in motor fuels taxes.

It’s despicable.

But it’s of a piece with everything else relating to electric cars. To give people the facts about EVs would be dangerous.

It might “discourage adoption” of them.

via IFTTT

InoreaderURL: SECONDARY LINK