Stockman On Washington's Panicked Bailout Of Bank Deposits... Here's What Comes Next

Authored by David Stockman via InternationalMan.com,

Why would you throw-in the towel now? We are referring to the Fed’s belated battle against inflation, which evidences few signs of having been successful.

Yet that’s what the entitled herd on Wall Street is loudly demanding. As usual, they want the stock indexes to start going back up after an extended drought and are using the purported “financial crisis” among smaller banks as the pretext.

Well, no, there isn’t any preventable crisis in the small banking sector. As we have demonstrated with respect to SVB and Signature Bank, and these are only the tip of the iceberg, the reckless cowboys who were running these institutions put their uninsured depositors at risk, and both should now be getting their just deserts.

To wit, executive stock options in the sector have plunged or become worthless, and that’s exactly the way capitalism is supposed to work. Likewise, on an honest free market their negligent large depositors should be losing their shirts, too.

After all, who ever told the latter that they were guaranteed 100 cents on the dollar by Uncle Sam? So it was their job, not the responsibility of the state, to look out for the safety of their money.

If the American people actually wanted the big boys bailed out, the Congress has had decades since at least the savings and loan crisis back in the 1980s to legislate a safety net for all depositors. But it didn’t for the good reason that 100% deposit guarantees would be a sure-fire recipe for reckless speculation by bankers on the asset-side of their balance sheets; and also because there was no consensus to put taxpayers in harms’ way in behalf of the working cash of Fortune 500 companies, smaller businesses, hedge funds, affluent depositors and an assortment of Silicon Valley VCs, founders, start-ups and billionaires, among countless others of the undeserving.

And for crying out loud, forget this baloney about the bailouts aren’t costing taxpayers a dime because they are being paid for by the banks via insurance premium payments to the FDIC fund. Well, yes, when the Congress wants to disguise a tax they call it an “insurance premium”, as if its victims had the choice to elect coverage or not. But when $18 trillion of deposits are being assessed in order to bailout careless large depositors who paid no attention to what was happening to their money, then that’s an onerous tax by any other name.

Accordingly, Washington’s panicked bailout of $9 trillion of uninsured deposits held by big and small companies, hedge funds and affluent customers over the weekend was therefore nothing less than a gift to the undeserving. And now we find out the two banks that have been explicitly funded 100% by Uncle Sam—SVB and Signature Bank—were deep into woke investing and conduct. That makes the bailout by Janet Yellen & Co. especially galling.

For crying out loud, this is how the poison of wokeness and ESG spread like wild-fire among American businesses in the first place. The latter should have ordinarily been a bulwark of conservative values and common sense, but years of ultra-easy money from the Fed and the precedent of bailout-after-bailout since the 1980s allowed top executives to take their noses off the grindstone of safe and sustainable profitability in favor of a purely political agenda.

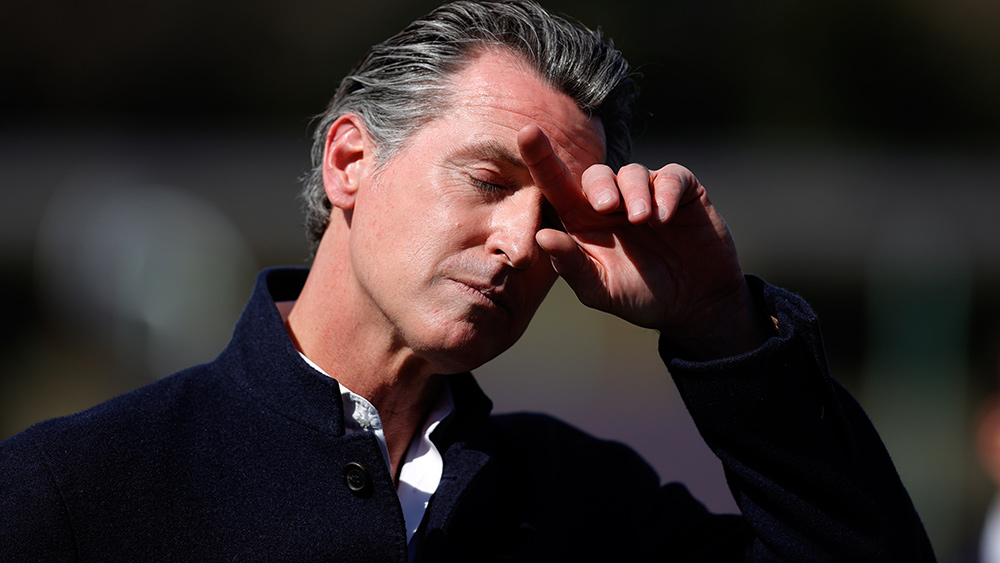

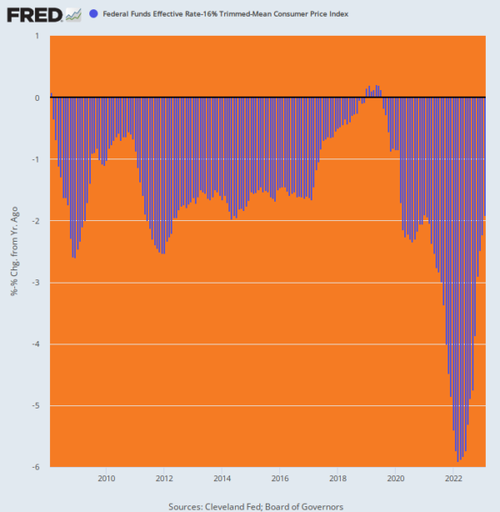

In any event, inflation is still raging and wage workers are still taking it on the chin. During February real wages dropped for the 23rd consecutive month. So the Fed needs to stay on its anti-inflation playbook, come hell or high water. That means it needs to keep raising rates until their after-inflation level is meaningfully positive, which is not yet remotely the case.

Indeed, unlike Tall Paul Volcker back in the late 1970s, who inherited 10-year Treasury yields at -2.0% and raised them to +10% over the next several years, real interest rates are still deeply underwater as we show below. The cries to stop the rate increases, therefore, are just damn nonsense.

In fact, in any sane world these are not even “increases”. They are long overdue normalization of interest rates that have been absurdly pinned to the zero bound for upwards of a decade.

And the Fed most certainly should not throw in the rate increase towel owing to a Wall Street proclaimed “crisis” in the small banking sector. That’s the long-standing wolf cry of the entitled class of speculators decamped in the digital canyons of Wall Street.

Yes, regional banks were playing fast and loose with depositor money, but even the biggest of these did not amount to a hill of beans in the great scheme of the nation’s $25 trillion GDP. As we showed a few days ago, both the recently departed SVB and Signature Bank each accounted for barely one-half of one percent of the nation’s $30 trillion of banking system assets.

If a few more local and regional banks need to be closed, therefore, so be it. Sooner or later the piper has to be paid.

Y/Y Change In Real Hourly Earnings, March 2021 to February 2023

For want of doubt, here is the pattern of the annual rate of change in the two-year stacked CPI. During the 18 months after January 2021 it soared from 1.9% to 7.1%. Yet notwithstanding the Fed’s purported anti-inflation campaign since March 2022, there has been no meaningful retreat from the June 2022 peak. That is, when you take the “base effects” out if the equation, it is clear that the CPI has been stranded at 40-year high levels at 7.0% ever since.

Annual Change, Two-Year Stacked CPI:

-

January 2021: 1.9%;

-

June 2021: 2.9%;

-

January 2022: 4.5%;

-

June 2022: 7.1%;

-

July 2022: 6.8%;

-

August 2022: 6.7%;

-

September 2022: 6.8%;

-

October 2022: 7.0%;

-

November 2022:7.0%;

-

December 2022: 6.8%;

-

January 2023: 7.0%;

-

February 2023: 7.0%

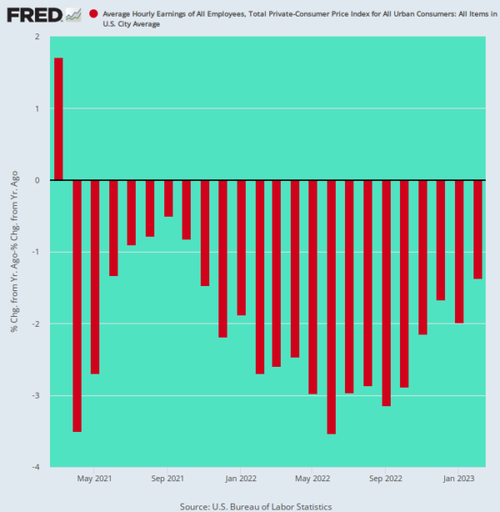

Nor is that the extent of the inflationary warning signs in the February CPI report. For example, plunging used car prices and the rollover of asking rents were supposed to be saving the day, bringing the headline CPI rate rapidly back toward the Fed’s 2.00% target.

But it’s not happening—-at least in the real world. On the matter of used vehicles there is nothing more authoritative than the Manheim used car auction index. But this real world index is going back up again, even as the green eyershades at the BLS insist that used vehicle prices are still going down.

Manheim Used Vehicle Index Change Versus CPI Used Vehicle Index

-

One Month (February): +4.3% vs. -2.8%;

-

Three Months: +7.8% vs. -5.3%;

-

Six Months: +2.0% vs. -11.0%

Eventually, of course, the BLS will make revisions and adjustments to catch-up with the real world, meaning that the purported anti-inflation impact of used car prices will soon turn into a booster shot.

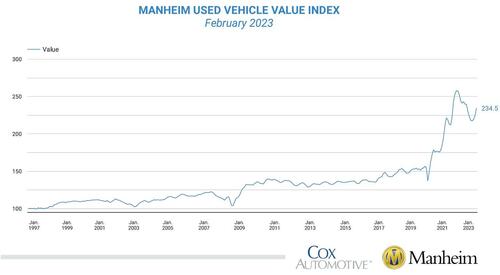

Likewise, the CPI shelter index for February was up at a near record 0.8% on a M/M basis and 8.1% from last February. As is evident from the chart, this component—which accounts for 24% of the weight in the headline CPI and 40% of the core CPI—is still accelerating, not cooling.

Change In CPI Shelter Index, Month/Month (Purple) and Year/Year (Black), 2021 to 2023

As we have previously noted, the argument that “asking rents” fell sharply during the back half of 2022 and that the CPI is therefore mis-reporting rent increases doesn’t wash. That because “asking rents” on new contracts account for just 1/12 of the rental market at best, and the reported numbers from private real estate companies are not seasonally adjusted.

As is evident in the chart below, rental rates always go down during the fall, and then come roaring back in the spring and early summer. In fact, right on schedule the February report by the Apartment List was back in positive territory.

In any event, what the CPI shelter index captures is the rolling increase in the total rent roll, not just the new contracts executed during the current month. And that means for the balance of this year at least—even if the overall housing market continues to weaken– average rents will be significantly higher on a year-over-year basis.

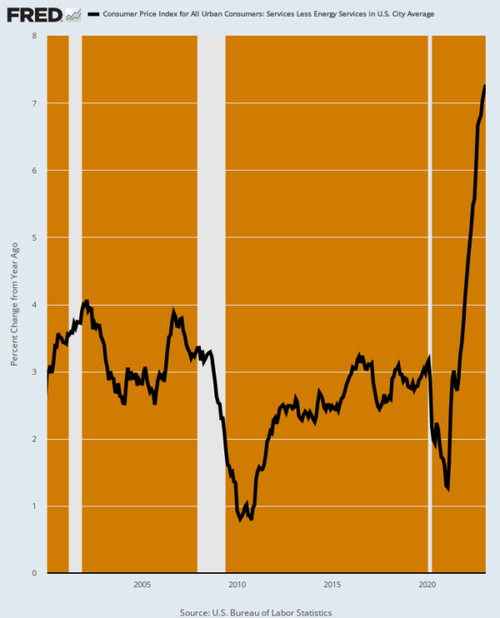

Finally, there was one further component in the February report that makes a mockery of the claim that the CPI is fixing to cliff-dive and that the Fed can therefore take its foot off the neck of the Wall Street gamblers. To wit, upwards of 60% of the CPI is accounted for by services less energy services, and this component was up 7.3% on a Y/Y basis, marking the largest such gain in 41 years!

So the Fed needs to keep its nose to the anti-inflation grindstone. It is not yet even close to turning the tide.

Y/Y Change In CPI For Services Less Energy, 2000 to 2023

As to the matter of imprudently managed banks, isn’t it finally time that all parties concerned - including large depositors - are made to pay the price for their feckless and reckless indifference to financial risk?

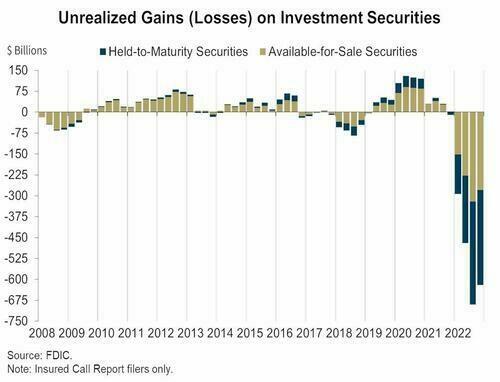

As a reminder, the unfolding of financial markets during 2022 was a screaming wake-up call that mis-matched bank portfolios were a train wreck waiting to happen. After all, last year the 30–year UST tanked by 39.2%, marking the greatest one-year decline since, well, 1754!

Likewise, the 10–year UST fell by 17.8%, another record vaporization of value. That’s why, of course, unrealized bank portfolio losses went from $15 billion in Q4 2021 to a staggering $650 billion in Q4 2022. And no one was hiding the ball—every dime of these potential losses were reported in the quarterly SEC filings.

Yet, and yet, bank executives and uninsured depositors sat on their hands because these soaring risks were not running through the income statement and thereby causing bank stock prices to fall even further. The whole theory behind this greatest ever outbreak of benign neglect was that all of the impacted Treasury and Agency securities generating these potential losses would be held to maturity and repaid in full.

Alas, that predicate was valid only to the extent that uninsured depositors sat on their hands permanently, and that imprudent folks like Peter Thiel and Ken Griffin would never yell “fire in the theater”.

They did, of course, and then the even greater fools in Washington enacted a $9 trillion deposit guarantee during the course of panicked deliberations in the White House Sunday afternoon.

So now that $18 trillion worth of US bank deposits have been totally euthanized economically by the geniuses in Washington, how do you stop bank managements from running wild on the asset-side of their balance sheet?

After all, they have already been making ungodly sums of money by mismatching their balance sheets, and now its Katie-bar-the-door.

Indeed, the Signature Bank fiasco is a poster boy for the art of minting fake profits off dangerous balance sheets. Not far below the surface we find the same old bank failure culprit: Namely, dirt cheap deposits thanks to the Fed, mismatched with substantially higher yielding but problematic assets.

Thus, in 2022 Signature Bank earned an average of 3.11% on its $114.3 billion of earning assets, while its cost of funding was just 0.88% on its $103.4 billion of deposits. In dollar terms, the assets generated $3.56 billion of gross income, while the bank paid out just $0.913 billion on its deposits.

Alas, if this were the widget business the above figures would amount to a sterling gross margin of 74%. And the resulting $2.54 billion of net interest margin wasn’t eaten up by SG&A, either. Net operating expense/fee income amounted to just $700 million, making Signature Bank an apparent goldmine in 2022

Yet just like that it was gone!

The reason is that its income statement was way too good to be true. The bank primarily catered to business operations in law, real estate and other professional services. Accordingly, like the case of SVB, fully 90% of its deposits base was not FDIC insured mom and pop savings accounts, but consisted of the working cash balances of its client firms.

At the same time, $70.2 billion of its $114.3 billion of earning assets were in commercial loans, mortgages and leases, which accounted for $2.80 billion of its $3.56 billion in gross income, owing to an average 4.0% yield on this part of the portfolio.

So at the heart of the operation was a 4% asset yield matched with a 0.88% deposit cost. And also a highly illiquid, sticky asset book (e.g. taxi medallion loans and low income housing mortgages) matched with deposits which were potentially hot and mobile, should its uninsured depositors ever get nervous and take flight.

They did, and in a New York minute the Signature Bank profits machine vaporized. And that’s to say nothing of its fixed income book which was drastically underwater owing to last year’s fixed income market bloodbath.

The only thing missing from Signature Bank’s financial picture is that it was not one of the 30 too-big-to-fail SIFIs (systemically important financial institutions), which were given a backdoor guarantee of uninsured depositors by Dodd-Frank. Then, like JP Morgan, its deposit costs would have been even cheaper and its fake profits even more fulsome.

As of 6:15 Pm Sunday night, of course, every bank now has the 100% safety net for uninsured deposits. This means that the 5,000 still living banks will have every opportunity to ignore their depositors and play even more artificial and remunerative games by mismatching their assets and liabilities.

Stated differently, banks have been way the hell too profitable thanks to the Fed’s insane financial repression and the rampant moral hazard of the bank regulatory and deposit insurance schemes. The top half dozen or so SIFI banks have actually booked more than $1 trillion of net income in the last eight years exactly because the geniuses in Washington have back-stopped and drastically cheapened their deposit carry costs.

The stock answer to all this from Washington and Wall Street alike is not to worry because new powers to the bank regulators will keep the cowboys from gestating more SVBs and Signature Banks.

Well, here is what Michael Barr, the top bank regulator on the Federal Reserve Board, had to say last Thursday morning when the fire at SVB was already raging:

“The banks we regulate, in contrast, are well protected from bank runs through a robust array of supervisory requirements.”

Or, as Elon Musk might have said, funding secured!

So at the end of the day there is no preventable financial crisis. What there is amounts to a systematic financial travesty that goes back to the hideously low money market regime that the Fed maintained since the eve of the financial crisis back in 2008, coupled with the evil of deposit insurance, both de jure and de facto.

The implicit policy of the Federal Reserve, as measured by the inflation-adjusted level of its target Fed funds rate, has been to blow-up the banking system by flooding it with dirt cheap deposit costs.

In fact, during the 180 months since Lehman there have been only seven months when the real rate was positive; and even then it was positive by just a hair as depicted by the blue bars peeking above the zero line in the chart below during early 2019.

Inflation-Adjusted Federal Funds Rate, 2008-2023

Likewise, it should be evident by now that deposit insurance has nothing to do with either sound money or a prudent banking industry.

It has remained in place for decades because it is a social policy-–protection of the little guy—parading as a financial stabilization measure.

But it doesn’t stabilize—it inherently and egregiously de-stabilizes, as has been implicit in every financial crisis during the last half century.

So if they want “social policy” for the little guy and the blue-haired ladies, give these folks access to a $250,000 government savings account paying 50 basis points of interest as far as the eye can see. For every one else, let them be the watch-dogs of their own money in the commercial banking system.

That’s the very predicate of a stable banking system and sustainable free market prosperity.

* * *

The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming. That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

via IFTTT

InoreaderURL: SECONDARY LINK

Image: @espinsegall/Twitter

Image: @espinsegall/Twitter