A peer-reviewed study from researchers in France has concluded that both the experimental Pfizer and Moderna vaccines significantly increase the risk of myocarditis compared to the unvaccinated.

ORIGINAL LINK

(Image courtesy Pixabay)

Perhaps the "New World Order," a phrase that has been use previously, many times negatively, has too much baggage.

Or perhaps there's another reason.

But a Biden administration official has just confirmed that Americans will have to keep paying those nearly $5 a gallon prices for gasoline because that's what's needed right now for the "Liberal World Order."

The comment came during a CNN appearance by Biden adviser Brian Deese.

He said, "This is about the future of the liberal world order and we have to stand firm."

His response was to a question about what to tell Americans facing those massively inflated gasoline prices under Biden's policies, where the cost of a tank of gasoline can easily surpass $100.

CNN: "What do you say to those families that say, 'listen, we can't afford to pay $4.85 a gallon for months, if not years?’"

BIDEN ADVISOR BRIAN DEESE: "This is about the future of the Liberal World Order and we have to stand firm." pic.twitter.com/LWilWSo72S

— Breaking911 (@Breaking911) July 1, 2022

Rod Dreher at the American Conservative said, "Yeah, why don’t you ask the working people struggling to fill up their cars how much they care about The Future Of The Liberal World Order. The unhappy fact is that Russia is going to win this war, and our oil and gas boycotts are not only not hurting Russia, but helping it get richer while impoverishing our own peoples. What sense does that make? In May, the governor of the Bank of England — the equivalent in the U.S. to the head of the Federal Reserve — warned of 'apocalyptic' food shortages coming later this year, as Ukraine produces 27 percent of the world’s wheat, but can’t export it because of the war. Like most people, I hate Russia’s war on Ukraine, but again, is it worth our own people going hungry to prevent Russia from prevailing in a war it will inevitably win anyway?"

At the Washington Examiner a report explained Deese's demands came just after Joe Biden "told reporters that the public should expect prices to remain at their current level for 'as long as it takes' for Ukraine to win the war against Russia."

He described current times as "uncertain," based on a poll revealing that 85% of Americans say the nation, under Biden, is on the wrong track.

"When prices are high, people are understandably frustrated when they are pulling up at the gas pump. That's understandable. At the same time, it is our job, and it’s the president’s firm conviction, that what he can do as president is to take every responsible action that he has, and we have and also remind the American people that even as we go through this challenging period, even whilst we move through this transition, we also have made historic economic progress," Deese noted.

The Daily Mail pointed out Deese, the chief of the National Economic Council, immediately was blasted by Rep. Byron Donalds, R-Fla.

"The Liberal World Order?! These people are nuts!," he said.

Sen. Ted Cruz, R-Texas, identified the comments as, "Completely out of touch."

The report explained just last week, Deese claimed the way to cut inflation was tax the rich and reform prescription prices.

He's also claimed inflation mostly comes from price increases in "prices in three products - in beef, in pork and in poultry."

Biden repeatedly has blamed the nation's roughly 8.6% inflation rate as "Putin's Price Hike," but analysts have pointed out much of the surge in prices, especially food and gasoline, came about before Putin invaded Ukraine, and under Biden's economic policies.

The report said Rep. Buddy Carter, R-Ga., has suggested the reason.

"Biden wants the Green New Deal, and he sees high gas prices as a tool to achieve it. The American people see through this and will reject his radical, anti-American policies in November. The Left is concerned with preserving their power. Republicans will give power back to the people," he said.

For 25 years, WND has boldly brought you the news that really matters. If you appreciate our Christian journalists and their uniquely truthful reporting and analysis, please help us by becoming a WND Insider!

If you like WND, get the news that matters most delivered directly to your inbox – for FREE!

Content created by the WND News Center is available for re-publication without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@wndnewscenter.org.

SUPPORT TRUTHFUL JOURNALISM. MAKE A DONATION TO THE NONPROFIT WND NEWS CENTER. THANK YOU!

The post Biden administration confirms goal is 'liberal world order' appeared first on WND.

Revised numbers on US GDP from the Bureau Of Economic Analysis indicate that the economy faces a deeper contraction than originally reported. GDP shrank in the first quarter of 2022 by 1.6%; this is an impressive and sharp reversal from the fourth quarter of last year, which saw GDP grow by 6.9% due primarily to the continued circulation of covid stimulus dollars and consumer credit spending.

It's important to keep in mind that this plunge in GDP occurred BEFORE the Federal Reserve started raising interest rates. Meaning, the Fed did in fact raise rates into economic weakness, much like they did during the onset of the Great Depression, causing even more damage to the economy in the process and prolonging the effects of the crisis. The difference this time is that we do not face a standard deflationary threat, but a stagflationary one. It's a completely different ballgame.

Calls for recession are ample from the mainstream financial media and many alternative analysts, though the assumption among many is that price inflation will track down as the recession pressures grow. This may not be the case.

Loss of buying power in the dollar due to central bank stimulus and numerous supply chain issues indicate an extended period of price inflation well into next year. Furthermore, with foreign central banks now incrementally dropping the dollar as the world reserve currency, there will be even more dollars flooding into the US from overseas. That's too many dollars chasing too few goods and services.

With the GDP decline more pronounced that initially thought, will the Fed capitulate quickly and end rate hikes? It's unlikely as long as price inflation continues through most of the economy. The Fed has made it clear that they are willing to let markets take a considerable hit as they pursue deflation. Suggestions in the media that a recession will create an immediate “equilibrium” in markets and in prices ring rather hollow and naive. These are the same people that were telling the world only a few months back that inflation was “transitory.”

Reflected in the fall in GDP is a growing concern among the public that the price explosion is going to eat away at their wallets and decrease their standard of living. It is also a signal that credit cards are finally maxed out and covid stimulus measures have finally faded away. When easy credit and stimulus move out of play the real economy is revealed, and in our case the true face is an ugly one.

Last Updated on June 30, 2022

The new “Baymax” children’s series was released on June 28th and is a spin-off of Disney’s “Big Hero 6,” following an inflatable “doctor-bot” named Baymax as he patrols his “San Fransokyo” neighborhood offering free healthcare and emotional support to his neighbors.

Thus far, the series consists of six, roughly nine-minute mini-episodes and is being directed to kids as young as 2-years-old while featuring several suggestive and subversive themes. In one video clip of the show making its rounds over the internet, the Baymax robot enters the tampon aisle of his local grocery store and starts asking a woman for advice on which feminine hygiene product is best.

“Excuse me, which of these products would you recommend?” Baymax asks the female customer before receiving a number of comments from other women, and even men, about the efficacy of certain tampons and pads.

In the process, a character appearing to be a teenage boy turns around, before it is realized that the “boy” is in fact a female, presenting as a male and wearing a transgender flag across her t-shirt while shopping for feminine hygiene products.

“I always get the ones with wings,” announces the trans character in a gravely masculine voice – something parents and cultural observers are blasting online as a deliberate, in-your-face attempt to confuse children, and indoctrinate them with far-left gender-bender values.

Disney's upcoming Big hero 6 spinoff series “Baymax,” discusses topics such a women’s menstrual cycle. pic.twitter.com/p9j5FAIvLl

— Joshua Jered (@Joshuajered) June 29, 2022

While the trans tampon scene has gotten the most attention online, it is far from the only chapter of Baymax that is causing concern among parents as the show is rolled out. In addition to including several scenes that could almost be described as an animated, televised version of “Social Emotional Learning,” where Baymax offers psychological assistance to his friends and neighbors, the show profiles the homosexual relationships of animated children and even describes their hormonal responses to apparent sexual tension.

Baymax says gay rights.

#Baymax #BigHero6 pic.twitter.com/GK28vZVelr

— quorra @ BAYMAX!

(@lucaspaguro) June 29, 2022

In addition to the latest dust-up over “Baymax,” Disney has made headlines on a regular basis as of late for their open sexualization and indoctrination of children, which often includes the promotion of homosexuality and transgenderism.

In the new children’s film “Lightyear!,” a homosexual relationship between two female characters is a central theme of the movie and culminates in a scene where the two are shown kissing as they raise a child together. While the content originally didn’t make the cut to be included in the movie, it was added back in after Disney employees became enraged by Florida legislation protecting kids at school from sexualization.

(by Michael Snyder | The Economic Collapse Blog) – If countries in Europe are already beginning to ration certain things due to “supply problems”, how long will it be before it starts happening in the United States? Up until the past couple of years, many of us in the western world always considered shortages to be something that only “unsophisticated” poor countries on the other side of the planet had to deal with. But the last couple of years have shown us that painful shortages can happen to wealthy countries in the western world too. At first we were told that […]

(by Michael Snyder | The Economic Collapse Blog) – If countries in Europe are already beginning to ration certain things due to “supply problems”, how long will it be before it starts happening in the United States? Up until the past couple of years, many of us in the western world always considered shortages to be something that only “unsophisticated” poor countries on the other side of the planet had to deal with. But the last couple of years have shown us that painful shortages can happen to wealthy countries in the western world too. At first we were told that […]

Doctors in Australia are concerned about a shocking increase in babies being diagnosed with common viruses in the past three weeks.

Aus 🇦🇺 Now we have Pandemic Babies ? 5% of babies born with co infection are ending up in ICU with Respiratory Illness, inflammation of Lungs, Heart and Brain….Ask yourself, how can they sit there with a straight face and pretend they don't know why…🧐🧐🧐🧐💣🔥👊 pic.twitter.com/YA8p1F1Phd

— 𝙍𝙄𝙎𝙀𝙈𝙀𝙇𝘽𝙊𝙐𝙍𝙉𝙀 (@risemelbourne) June 28, 2022

Health workers say infants born during the Covid pandemic are being put in the ICU with severe cases of influenza, RSV and Covid.

The flu is specifically wreaking havoc, counting for many more hospital admissions in children than Covid.

An infectious diseases pediatrician at the Children’s Hospital at Westmead named Dr. Philip Britton told The Daily Telegraph, “Over the last month or so, we have seen four times the admissions to hospital for flu in children as for Covid.”

New South Wales doctors were worried three weeks ago when there were 355 RSV cases in one week.

Now, the number is up to an alarming 3,775 in a week.

Some doctors are theorizing that young children are becoming more ill due to their lack of exposure to viruses during pandemic lockdowns.

This is likely not helping the situation, but another possible link to the children’s lack of immunity could have been passed down from their parents.

Since the experimental Covid-19 mRNA jabs were not tested as thoroughly as they should have been, the people of the world are still just guinea pigs in the world’s largest science experiment.

The UK government in October 2021 revealed Covid-19 vaccines appear to inhibit the body’s natural ability to produce antibodies, which leaves vaccinated people vulnerable to infection.

Also in 2021, an Illinois physician demonstrated how the Covid vaccine suppresses the body’s adaptive immune system, leaving vaccinated individuals more susceptible to illness and possibly explaining the phenomenon of “breakthrough infections.”

European Union regulators warned in January that repeated Covid-19 boosters would eventually destroy the immune response of those being injected.

Alex Jones exposed the immune system-destroying Covid jabs during a July 2021 transmission.

Jones played a video clip of top Covid vaccine developer Dr. David LV Bauer admitting the shots destroy the body’s immune response and lower crucial antibodies necessary to fight off disease.

“Here’s David LV Bauer, who heads up the program at the main bioweapons lab in London, England that started the first shots, that’s going after the kids, that’s doing the trials on children,” Jones said. “He studies their blood to see what happens, and he heads the project up. Here he is telling you that it reduces your immune system massively when you take it so gotta have more shots in the future. Talk about capturing humanity!”

Former British MEP James Freeman asked on Twitter why his government told pregnant women the experimental shots were safe “when Pfizer trial data shows otherwise,” citing Australia’s “pandemic babies” as a possible result of inoculating pregnant women.

Why did GOV advise pregnant women the jabs are safe when Pfizer trial data shows otherwise?

Did GOV know about Pfizer trial data @sajidjavid?

👇

'Pandemic babies' with no immunity ending up in intensive care across Australia with respiratory illnesseshttps://t.co/pmzLRxLwJC— James Freeman (@JamesfWells) June 28, 2022

Sadly, this is only the beginning of this tragic trend.

Look for the weakened immune systems of children across the globe to be a major worldwide story within weeks to months.

Amid the ongoing events in Ukraine, on May 18, Finland and Sweden submitted applications to join NATO. Although Turkey initially blocked the initiatives, the three nations signed a memorandum on Tuesday addressing Ankara’s concerns, paving the way for the two Northern European countries to join the military bloc.

Russian President Vladimir Putin underscored Wednesday that Moscow’s relations with Sweden and Finland are nowhere near as conflicting as Russia’s standing is with Ukraine, and that it would not object to its NATO membership.

However, should the block’s military infrastructure be deployed to the two nordic countries, Russia would be forced to respond in a ‘mirror way.’

Speaking at the Sixth Caspian Summit held in Turkmenistan this week, Putin emphasized the Kremlin has “nothing that could worry us in terms of Finland or Sweden’s membership in NATO,” and both countries are free to become members of the alliance.

He pointed out, however, that “there was no threat before,” but if military equipment or troops are deployed along the border, Moscow will have to “respond in a mirror manner and create the same threats in the territories from which they threaten us.”

The Russian president further rejected claims that Moscow’s move to push NATO forces away from its border and object to Ukraine’s NATO membership are having the opposite effect, stressing that allegations were “having nothing to do with reality.”

“For us, the membership of Finland and Sweden in NATO is not at all the same as the membership of Ukraine, these are completely different things. They understand this very well. […] No. This is a completely different thing,” Putin said, per the translation.

Putin stressed that, unlike Ukraine, Sweden and Finland do not persecute people who culturally identify as Russian.

The Russian president stressed to reporters that the special military operation in Ukraine is going according to plan, and it is wrong to adjust it according to some schedule. The Russian troops are achieving their goals on the battlefield.

“We are working calmly, the troops are moving, reaching the lines that are set as objectives. Everything is going according to plan,” he told reporters, noting that it is not worth talking about a timetable for the operation.Putin further said that the goals of the special operation in Ukraine have not changed, but the tactics may be different.

“Nothing has changed, I said in the early morning of February 24 directly publicly to the whole country, to the whole world. I have nothing to add to this. Nothing has changed,” Putin said. “The tactics being proposed by the Ministry of Defense, [such as] where to move the troops, what objects to hit.”

As for the operation’s ultimate goal, the president noted that it is to protect the Donbass and create conditions that guarantee the security of Russia itself.

Putin said it was no surprise to Russia that the West had been preparing for active action against it since 2014.

“We must treat this as a fact. The fact that they have been preparing for some kind of actions against us since 2014 is not news to us. This is precisely what explains our decisive actions to protect our own interests,” he explained.

The president asserted the US had long declared Russia a foreign enemy, alleging a threat from which it would be possible to unite allies around itself. Putin argued that Iran “was not very suitable for this,” while Russia is more convenient.

Then, Putin stated that the current events and the state of the relationship confirm what Moscow has been discussing “all the time,” namely that NATO is “a vestige of a past era, the era of the Cold War.”

“We were constantly told that NATO has changed, that this is now most likely a political union. But everyone was looking for a reason and an opportunity to give them a new impetus precisely as a military organization. Well, please, they are doing it. There is nothing new for us here,” Putin said.

Furthermore, calls for Ukraine to continue the hostilities indicate that for the West, Ukraine is only a means to achieve its own interests, as there is no concern for what is good for the country, the president suggested.

According to him, “with the hands of the Ukrainian people,” NATO members “simply want to assert themselves additionally, assert their role in the world, confirm not their leadership, but their hegemonism in the truest sense of the word, their imperial ambitions.

“What the bloc has long said about their exclusiveness, and the claims that “whoever is not with us is against us,” is all a manifestation of the same policy, Putin claimed.

Answering a question about the recent missile attack in the Ukrainian city of Kremenchug, Poltava region, which resulted in a shopping mall suffering some heavy damage, Putin said that no terrorist attack took place there, adding that that “no one shoots in the fields just like that.” Putin stressed that the missile strikes on Ukrainian soil are based on the results of reconnaissance, and the Russian military does not fire at civilian targets.

The explosion in the shopping center occurred on June 27. After the explosion, a fire broke out throughout the shopping center. According to the office of the president of Ukraine, at the time of the explosion, there were more than a thousand civilians in the area. It was reported that 13 people died, and at least 50 people were injured.The Russian Defense Ministry said that the fire was the result of a Russian missile attack on hangars with Western weapons. According to the military, as a result of the impact, a fire broke out in a nearby shopping center. The ministry claimed that the shopping center was not operational before the strike.

Addressing a ‘joke’ made by G7 leaders mocking photos of Putin’s bare chest, the Russian leader responded simply by saying it would be a “disgusting sight” to behold if the gathered leaders did in fact remove their clothing to demonstrate their toughness.

“I don’t know how they wanted to undress: waist-high, below the waist, but I think it would be a disgusting sight,” Putin said. Earlier, the G7 leaders were talking about the Russian president over lunch and discussed whether they should strip to show they were “tougher” than Putin.

British Prime Minister Boris Johnson, sitting down at the table, asked whether they should take off their jackets, whereas Canadian Prime Minister Justin Trudeau responded by suggesting that they wait until the official photo was taken before undressing. Johnson then joked that the leaders “have to show that we are tougher than Putin.”

A day after Fed Chair Powell crowed once again how the US economy was strong enough to cope with his hawkish rate-hike cycle (and President Biden told the world this morning that the US economy is the strongest in the world), the Atlanta Fed just stole the jam out of everyone's donut by confirming the recession has started.

If you were curious why bond yields are plunging and rate-hike expectations are falling, then here's your answer, courtesy of the Atlanta Fed, which just confirmed the economy is in technical recession.

I may be the only person besides Jay Powell who believes we are not going to have a recession. At least i hope Jay thinks that way!

— Jim Cramer (@jimcramer) June 3, 2022

The continued erosion in economic data has prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from 0.0% to -1.0%+0.9% to 0.0%, meaning the US is now right on the verge of a technical recession (after Q1's confirmed 1.6% contraction yesterday).

According to the Atlanta Fed's GDPNow model estimate for real GDP, growth in the second quarter of 2022 has been cut to a contractionary -1.0%, down from 0.0% on June 15, down from +0.9% on June 6, down from 1.3% on June 1, and down from 1.9% on May 27.

As the AtlantaFed notes, "The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.0 percent on June 30, down from 0.3 percent on June 27. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 2.7 percent and -8.1 percent, respectively, to 1.7 percent and -13.2 percent, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth increased from -0.11 percentage points to 0.35 percentage points."

In short: the US consumer is getting tapped out, just as we have been warning repeatedly.

Which also fits with Jamie Dimon's recent "downgrade" of the economy from "storm clouds" to "hurricane"... and also makes some sense given the recent collapse in macro data relative to expectations...

And longer-term, the trend towards stagflation could not be clearer...

And this is increasingly problematic for The Fed, as the market is now betting Powell and his pals won't get close to hiking as much as they hope...

And in fact the market is now expecting rate-cuts to start in Q1 2023...

Will The Fed adjust to the market once again?

Meaning The Fed is now hiking rates into a recession...

Today https://t.co/MmfB76vWpB

— zerohedge (@zerohedge) June 30, 2022

...and the market is already pricing in more than 3 rate-cuts to address that recession.

Get back to work Mr.Powell.

Authored by Matthew Piepenburg via GoldSwitzerland.com,

If you think the current market disaster hurts; it’s gonna get worse despite recent dead cat bounces in U.S. equities.

For well over a year before fantasy-pushers and politicized, central-bank mouth pieces like Powell and Yellen were preaching “transitory inflation,” or hinting that “we may never see another financial crisis in our lifetime,” we’ve been patiently and bluntly (rather than “gloomily”) warning investors of the “Big Four.”

That is, we saw an: 1) inevitable liquidity crisis which would take our 2) zombie bond markets to the floor, yields (and hence interest rates) to new highs and 3) debt-soaked nations and markets tanking dangerously south into 4) the dark days of stagflation.

In short, by calmly tracking empirical data and cyclical debt patterns, one does not have to be a market timer, tarot-reader or broken watch of “doom and gloom” to warn of an unavoidable credit, equity, inflation and currency crisis, all of which lead to levels of increasing political and social crisis and ultimately extreme control from the top down.

Such are the currents of history and the tides/fates of broke(n) regimes.

And that is precisely where we are today—no longer warning of a pending convergence of crises, but already well into a market disaster within the worst macro-economic setting (compliments of cornered “central planners”) that I have ever experienced in my post-dot.com career.

But sadly, and I do mean sadly, the worst is yet to come.

As always, facts rather than sensationalism confirm such hard conclusions, and hence we turn now to some equally hard facts behind this market disaster.

For well over a decade, the post-2008 central bankers of the world have been selling the intoxicating elixir (i.e., lie) that a debt crisis can be solved with more debt, which is then paid for with mouse-click money.

Investors drank this elixir with abandon as markets ripped to unprecedented highs on an inflationary wave of money printed out of thin air by a central bank near you.

In case you still don’t know what such “correlation” looks like, see below:

But as we’ve warned in interview after interview and report after report, the only thing mouse-click money does is make markets drunker rather than immune from a fatal hangover and market disaster.

For years, such free money from the global central banks ($35T and counting) has merely postponed rather than outlawed the hangover, but as we are seeing below, the hangover, and puking, has already begun in a stock, credit or currency market disaster near you.

Why?

Because the money (i.e., “liquidity”) that makes this drunken fantasy go round is drying up (or “tightening”) as the debt levels are piling up.

That is, years and years of issuing IOU’s (i.e., sovereign bonds) has made those IOU’s less attractive, and the solution-myth of creating money out of thin air to pay for those IOUs is becoming less believable as inflation rises like a killer shark from beneath the feet of our money printers.

As we’ve warned, the UST is experiencing a liquidity problem.

Demand for Uncle Sam’s bar tab (IOU’s) is tanking month, after month, after month.

As a result, the price of those bonds is falling and hence their yields (and our interest rates) are rising, creating massive levels of pain in an already debt-saturated world where rising rates kill drunken credit parties (i.e., markets).

Toward this end, Wall Street is seeing a dangerous rise in what the fancy lads call “omit days,” which basically means days wherein inter-dealer liquidity for UST’s is simply not available.

Such omit days are screaming signs of “uh-oh” which go un-noticed by 99.99% of the consensus-think financial advisors selling traditional stocks and bonds for a fee.

As the repo warnings (as well as our written warnings) have made clear since September of 2019, when liquidity in the credit markets tightens, the entire risk asset bubble (stocks, bonds and property) starts to cough, wheeze and then choke to death.

Unfortunately, the extraordinary levels of global debt in general, and US public debt in particular, means there’s simply no way to avoid more choking to come

As all debt-soaked nations or regimes since the days of ancient Rome remind us , once debt levels exceed income levels by 100% or more, the only option left is to “inflate away” that debt by debasing (i.e., expanding/diluting) the currency—which is the very definition of inflation.

And that inflation is only just beginning…

Despite pretending to “control,” “allow” and then “combat” inflation, truth-challenged central bankers like Powell, Kuroda and Lagarde have therefore been actively seeking to create inflation and hence reduce their debt to GDP ratios below the fatal triple digit level.

Unfortunately for the central bankers in general and Powell in particular, this ploy has not worked, as the US public debt to GDP ratio continues to stare down the 120% barrel and the Fed now blindly follows a doomed policy of tightening into a debt crisis.

This can only mean higher costs of debt, which can only mean our already debt-soaked bond and stock markets have much further to go/tank.

In sum, what we are seeing from DC to Brussels, Tokyo and beyond is now an open and obvious (rather than pending, theoretical or warned) bond dysfunction thanks to years of artificial bond “accommodation” (i.e., central-bank bond buying with mouse-click currencies).

As we recently warned, signals from that toxic waste dump (i.e., market sector) known as MBS (“Mortgage-Backed Securities”) provide more objective signs of this bond dysfunction (market disaster) playing out in real-time.

Earlier this month, as the CPI inflation scale went further (and predictably) up rather down, the MBS market went “no bid,” which just means no one wanted to buy those baskets of unloved bonds.

This lack of demand merely sends the yields (and hence rates) for all mortgages higher.

On June 10, the rates for 30-year fixed mortgages in the U.S. went from 5.5% to 6% overnight, signaling one of the many symptoms of a dying property bull as U.S. housing starts reached 13-month lows and building permits across the nation fell like dominoes.

Meanwhile, other warnings in the commercial bond market, from Investment Grade to Junk Bonds, serve as just more symptoms of a dysfunctional “no-income” (as opposed to “fixed income”) U.S. bond market.

And in case you haven’t noticed, the CDS (i.e., “insurance”) market for junk bonds is rising and rising.

Of course, central bankers like Powell will blame the inevitable death of this U.S. credit bubble on inflation caused by Putin alone rather than decades of central bank drunk driving and inflationary broad money supply expansion.

Powell is already confessing that a soft landing from the current inflation crisis is now “out of his hands” as energy prices skyrocket thanks to Putin.

There’s no denying the “Putin effect” on energy prices, but what’s astounding is that Powell, and other central bankers have forgotten to mention how fragile (i.e., bloated) Western financial systems became under his/their watch.

Decades of cramming rates to the floor and printing trillions from thin air has made the U.S. in particular, and the West in general, hyper-fragile; that is: Too weak to withstand pushback from less indebted bullies like Putin.

But as we warned almost from day 1 of the February sanctions against Russia, they were bound to back-fire big time and accelerate an unraveling inflationary disaster in the West.

As we warned in February, Russia is squeezing the sanction-makers with greater pain than history-and-math-ignorant “statesmen” like Kamala Harris could ever grasp.

From here in Europe, Western politicians are beginning to wonder if following the U.S. lead (coercion?) in chest-puffing was a wise idea, as gas prices on the continent skyrocket.

In this backdrop of rising energy costs, Germany, whose PPI is already at 30%, has to be asking itself if it can afford tough-talk in the Ukraine as Putin threatens to cut further energy supplies.

In this cold reality, the geniuses at the ECB are realizing that the very “state of their European Union” is at increasing risk of dis-union as citizens from Italy to Austria bend under the weight of higher prices and falling income.

As of this writing, the openly nervous ECB is thus inventing clever plans/titles to “fight fragmentation” within the EU by, you guessed it: Printing more money out of thin air to control bond yields and cap borrowing costs.

Of course, such pre-warned and inevitable (as well as politicized) versions of yield curve controls (YCC) are themselves, just well…Inflationary.

Even outside the EU, the UK’s Prime Minister is discussing the idea of handing out free money to the bottom 30% of its population as a means to combat inflating prices, equally forgetting to recognize that such handouts are by their very nature just, well…Inflationary.

(By the way, such monetary policies are an open signal to short the Euro and GBP against the USD…)

Looking further east to that equally embarrassing state of the union in Japan, we see, as warned countless times, a tanking Yen out of a Japan that knows all too well the inflationary sickness that a non-stop money printer can create.

Like the UST, the Japanese JGB is as unloved as a pig in lipstick. Prices are falling and yields are rising.

As demand for Japanese IOU’s falls, yields and rates are rising, compelling more YCC (i.e., money printing) from the Bank of Japan as the now vicious (and well…inflationary) circle of printing more currencies to pay for more debt/IOUs spins/spirals fatally round and round.

By the way, and as part of our continued warning and theme of the slow process of de-dollarizationwhich the sanctions have only accelerated, it would not surprise us to see Japan making a similar “China-like” move to buy its Russian oil in its own currency rather than the USD.

Just saying…

As indicated above, trying to combat inflation with rate hikes is not only a joke, it creates a market disaster when a nation’s debt to GDP is at 120%.

To fight inflation, rates need be at a “neutral level,” (i.e., above inflation), and folks, that would mean 9% rates at the current 8%+ CPI level.

That aint gonna happen…

At $30T+ of government debt and rising, the Fed can NEVER use rising rates to fight inflation. End of story. The days of Volcker rate hikes (when public debt was $900B not $30T) are gone.

But the fickle Fed can raise rates high enough to kill a securities bubble and create “asset-bubble deflation,” which is precisely what we are seeing in real time, and this market disaster is only going to get worse.

In short, if you are buying this “dip,” you may want to think again.

As June trade tapes remind, the Dow dipped below 30000, and the S&P 500 reported an ominous 3666, already losing more than 20% despite remaining grossly over-valued as it slides officially into bear territory.

As for the NASDAQ’s -30% YTD loss, well, it’s embarrassing…

Many, of course, will buy this dip, as many forget the data, facts and traps of dead-cat bounces.

Toward this end, it’s worth reminding that 12 of the top 20 one-day rallies in the NASDAQ occurred after that market began a nearly 80% plunge between 2000 and 2003.

Similarly, the S&P saw 9 of its top 20 one-day rallies following the 1929 crash in which that market lost 86% from its highs.

In short: These bear markets are not even close to their bottom, and today’s dip-buy may just be a trap, unless you think you can time a one-day rally amidst years of falling assets.

Markets won’t and don’t recover from the bear’s claws until spikes are well above two standard deviations. We are not there yet, which means we have much further to fall.

Capitulation in U.S. stocks won’t even be a discussion until the DOW is below 28,400 and the S&P blow 3500. Over the course of this bear, I see both falling much further.

As we’ve warned, mean-reversion is a powerful force and we see deeper lows/reversions ahead:

Toward that end, we see an SPX which could easily fall at least 15% lower (i.e., to at least 1850) than the “Covid crash” of March 2020.

Based upon historic ranges, stocks won’t be anywhere near “fair value” until we see a Shiller PE at 16 or a nominal PE of 9-10.

Index bubbles have been driven by ETF inflation which followed the Fed liquidity binge—and those ETF’s will fall far faster in a market disaster than they grew in a Fed tailwind.

And if you still think meme stocks, alt coins or the Fed itself can save you from further market disaster, we’d (again) suggest you think otherwise.

Looking at historical data on prior crashes from 1968 to the present, the average bear crash is at around -33%.

Unfortunately, there’s nothing “average” about this bear or the further falls to come. The Shiller PE, for example, has another 40% to go (down) before stocks approach anything close to “fair value.”

In the 1970’s, for example, when we saw the S&P lose 48%, or even in 2008, when it lost 56%, U.S. debt to GDP levels were ¼ of what they are today. Furthermore, in the 1970’s the average consumer savings rate was 12%; today that rate is 4%.

Stated simply, the U.S., like the EU and Japan, is too debt-crippled and too GDP-broke to make this bear short and sweet. Instead, it will be long and mean, accompanied by stagflation and rising unemployment.

The Fed knows this, and is, in part, raising rates today so that will have something—anything—to cut in the market disaster tomorrow.

But that will be far too little, and far too late.

Of course, the Fed, the IMF, the Davos crowd, the MSM and the chest-puffing sanction (back-firing) West will blame the current and future global market disaster on a virus with a 99% survival rate and an avoidable war in a corner of Europe that neither Biden nor Harris could find on a map.

Instead, and as most already know, the real cause of the greatest market bubble and bust in the history of modern capital markets lies in the reflection of central bankers and politicians who bought time, votes, market bubbles, wealth disparity and cancerous inflation with a mouse-click.

History reminds us of this, current facts confirm it.

For now, the Fed will tighten, and thereby unleash an even angrier bear.

Then, as we’ve warned, the Fed will likely pivot to more rate cuts and even more printed (inflationary) currencies as the US, the EU and Japan engage in more inflationary YCC and an inevitable as well as disorderly “re-set” already well telegraphed by the IMF.

In either/any scenario, gold gets the last laugh.

Gold, of course, has held its own even as rates and the USD have risen—typically classic gold headwinds. When markets tank and the Fed pivots, yields on the 10Y could fall as global growth weakens—thus providing a gold tailwind.

Furthermore, the USD’s days of relative strength are equally numbered, as is the current high demand for US T-Bill-backed collateral for that USD. As the slow trend toward de-dollarization increases, so will the tailwind and hence price of gold increase as the USD’s credibility decreases.

In the interim, the fact that gold has stayed strong despite the temporary spike in the USD speaks volumes.

In the interim, Gold outperforms tanking stocks by a median range of 45%, and when the inflationary pivot to more QE returns, gold protects longer-term investors from grotesquely (and increasingly) debased currencies.

And when (not if) the re-set toward CBDC (central bank digital currencies) finally arrives, that blockchain eYen and eDollar will need a linkage to a neutral commodity not to an empty “faith & trust” in just another new fiat/fantasy with an electronic profile.

As we’ve been saying for decades: Gold Matters.

It was supposed to be a 7% ramp into month-end on billions in pension fund residual buying.

Instead, it ended up being more or less the opposite, with crypto-led liquidations dragging futures and global markets lower, and extending Wednesday losses after central bankers issued warnings on inflation and fueled concern that aggressive policy will end with a hard-landing recession, which increasingly more now see as being 2022 business, an outcome that now appears assured especially after yesterday's disastrous guidance cut from RH, the second in three weeks!

Recession fears and inflation woes may be prolonged by today's PCE deflator report. The consumer price gauge favored by the Fed may have picked up to 6.4% last month from 6.3%. Personal income growth probably edged up but Bloomberg Economics highlights an anticipated decline in real personal spending as a major worry.

Meanwhile, China’s economy showed further signs of improvement in June with a strong pickup in services and construction, even if the latest Chinese PMI print came slightly below expectations. Also overnight, Russia said it withdrew troops from Ukraine’s Snake Island in the Black Sea after Ukraine said its forces drove Russian troops from the area.

In any case, with zero demand from pensions so far (even though the continued selling in stocks and buying in bonds will only make the imabalnce bigger), overnight Nasdaq 100 contracts dropped 1.8% while S&P 500 futures declined 1.3%, and cryptos crumbled, with bitcoin dragged back below $19000 and Ether on the verge of sliding below $1000. The tech-heavy gauge managed to end Wednesday’s trading slightly higher, while the S&P 500 fell for a third straight day. In Europe, the Stoxx Europe 600 Index slid 1.9%. Treasuries gained, the dollar was steady and gold declined and crude oil futures edged lower again.

Which brings us to the last trading day of a quarter for the history books: the S&P 500 is set for its biggest 1H decline since 1970 and the Nasdaq 100 since 2002, the height of the dot.com bust. The Stoxx 600 is set for the worst 1H since 2008, the height of the GFC.

Traders have ramped up bets that the global economy will buckle under central bank tightening campaigns -- and that policy makers will eventually backpedal. The bond market shifted to price in a half-point rate cut in the Federal Reserve’s benchmark rate at some point in 2023. On Wednesday, during the annual ECB annual forum, Fed Chair Jerome Powell and his counterparts in Europe and the UK warned inflation is going to be longer lasting. A view that central banks need to act fast on rates because they misjudged inflation has roiled markets this year, with global stocks about to close out their worst quarter since the three months ended March 2020.

“Markets are worried about growth as central bankers continue to emphasize that bringing down inflation is their overriding objective, and that it may take time to bring inflation down,” said Esty Dwek, chief investment officer at Flowbank SA. “We still haven’t seen total capitulation in markets, so further downside is possible.”

Meanwhile, the cost of insuring European junk bonds against default crossed 600 basis points for the first time in two years on Thursday.

And speaking of Europe, stocks are also down over 2% in early trading, with all sectors in the red. DAX and CAC underperform at the margin with autos, consumer discretionary and banking sectors the weakest within the Stoxx 600. Here are some of the biggest European movers today:

Earlier in the session, Asian stocks fell for a second day as tech-heavy indexes in Taiwan and South Korea continued to get pummeled amid concerns over the potential for aggressive monetary tightening in the US to rein in inflation. The MSCI Asia Pacific Index declined as much as 1.2%, dragged down by technology shares including TSMC, Alibaba and Tencent. Taiwan slid more than 2%, while gauges in Japan, South Korea, Australia dropped more than 1%. Stocks in mainland China rose more than 1% after the economy showed further signs of improvement in June with a strong pickup in services and construction as Covid outbreaks and restrictions were gradually eased. Traders are also watching Chinese President Xi Jinping’s trip to Hong Kong, his first time outside of the mainland since 2020.

Asian stocks are struggling to recover from a May low as the threat of higher US rates outweighs China’s emergence from strict Covid lockdowns and its pledge of stimulus measures. While mainland Chinese stocks led gains globally this month, the rest of the markets in the region -- especially those heavy with technology stocks and exporters -- saw hefty outflows of foreign funds. “Investors continue to assess recession and also inflation risks,” Marcella Chow, JPMorgan Asset Management’s global market strategist, said in an interview with Bloomberg TV. “This tightening path has actually increased the chance of a slower economic growth going forward and probably has brought forward the recession risks.” Asian stocks are set to post a more than 12% loss this quarter, the worst since the one ended March 2020 during the pandemic-induced global market rout.

Japanese stocks declined after the release of China’s data on manufacturing and non-manufacturing PMIs that showed slower than expected improvements. The Topix Index fell 1.2% to 1,870.82 as of market close Tokyo time, while the Nikkei declined 1.5% to 26,393.04. Sony Group contributed the most to the Topix Index decline, falling 3.4%. Out of 2,170 shares in the index, 531 rose and 1,574 fell, while 65 were unchanged. “Although China is recovering from a lockdown, business sentiment in the manufacturing industry is deteriorating around the world,” said Tomo Kinoshita, global market strategist at Invesco Asset Management China’s Economy Shows Signs of Improvement as Covid Eases.

Indian stock indexes posted their biggest quarterly loss since March 2020 as the global equity market stays rattled by high inflation and a weakening outlook for economic growth. The S&P BSE Sensex ended little changed at 53,018.94 in Mumbai on Thursday, while the NSE Nifty 50 Index dropped 0.1%. The gauges shed more than 9% each in the June quarter, their biggest drop since the outbreak of pandemic shook the global markets in March 2020. The main indexes have fallen for all but one month this year as surging cost pressures forced India’s central bank to raise rates twice and tighten liquidity conditions. The selloff is also partly driven by record foreign outflows of more than $28b this year. Despite the turmoil in global markets, Indian stocks have underperformed most Asian peers, partly helped by inflows from local institutions, which made net purchases of more than $30b of local stocks. “Investors worry that the latest show of central bank determination to tame inflation will slow economies rapidly,” HDFC Securities analyst Deepak Jasani wrote in a note. Fourteen of the 19 sector sub-gauges compiled by BSE Ltd. fell Thursday, with metal stocks leading the plunge. The expiry of monthly derivative contracts also weighed on markets. For the June quarter, metal stocks were the worst performers, dropping 31% while information technology gauge fell 22%. Automakers led the three advancing sectors with 11.3% gain.

Australian stocks also tumbled, with the S&P/ASX 200 index falling 2% to close at 6,568.10, weighed down by losses in mining, utilities and energy stocks. In New Zealand, the S&P/NZX 50 index fell 0.8% to 10,868.70

In rates, treasuries advanced, led by the belly of the curve. German bonds surged, led by the short-end and outperforming Treasuries. US yields richer by as much as 5.4bp across front-end and belly of the curve which outperforms, steepening 2s10s, 5s30s by 2bp and 2.8bp; wider bull-steepening move in progress for German curve with yields richer by up to 13.5bp across front-end with 2s10s wider by 3.5bp on the day. US 10-year yields around 3.055%, richer by 3.5bp. Money markets aggressively trimmed ECB tightening bets on relief that French June inflation didn’t come in above the median estimate. Bonds also benefitted from haven buying as stocks slide. Month-end extension flows may continue to support long-end of the Treasuries curve. bunds outperform by 7bp in the sector. IG issuance slate empty so far; Celanese Corp. pushed back plans to issue in euros and dollars, most likely to next week, after deals struggled earlier this week. Focal points of US session include PCE deflator and MNI Chicago PMI.

In FX, the Bloomberg Dollar Spot Index was steady as the greenback traded mixed against its Group-of-10 peers. The yen advanced and Antipodean currencies were steady against the greenback. French inflation quickened to the fastest since the euro was introduced. Steeper increases in energy and food costs drove consumer-price growth to 6.5% in June from 5.8% in May . Sweden’s krona swung to a loss. It briefly advanced earlier after the Riksbank raised its policy rate by 50bps, as expected, signaled faster rate hikes and a quicker trimming of the balance sheet. The pound rose, snapping three days of losses against the dollar. UK household incomes are on their longest downward trend on record, as the nation’s cost of living crisis saps the spending power of British households. Separate figures showed that the current-account deficit widened sharply to £51.7 billion ($63 billion) in the first quarter. The yen rose and the Japan’s bonds inched up. The BOJ kept the amount and frequencies of planned bond purchases unchanged in the July-September period. The Australian dollar reversed a loss after data showed China’s official manufacturing purchasing managers index rose above 50 for the first time since February in a sign of improvement in the world’s second largest economy.

Bitcoin is on track for its worst quarter in more than a decade, as more hawkish central banks and a string of high-profile crypto blowups hammer sentiment. The 58% drawdown in the biggest cryptocurrency is the largest since the third quarter of 2011, when Bitcoin was still in its infancy, data compiled by Bloomberg show.

In commodities, WTI trades a narrow range, holding below $110. Brent trades either side of $116. Most base metals trade in the red; LME zinc falls 3.1%, underperforming peers. Spot gold falls roughly $3 to trade near $1,814/oz. Bitcoin slumps over 6% before finding support near $19,000.

Looking to the day ahead now, data releases include German retail sales for May and unemployment for June, French CPI for June, the Euro Area unemployment rate for May, Canadian GDP for April, whilst the US has personal income and personal spending for May, the weekly initial jobless claims, and the MNI Chicago PMI for June.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were varied at month-end amid a slew of data releases including mixed Chinese PMIs. ASX 200 was dragged lower by weakness in energy, miners and the top-weighted financials sector. Nikkei 225 declined after disappointing Industrial Production data and with Tokyo raising its virus infection level. Hang Seng and Shanghai Comp. were somewhat mixed with Hong Kong indecisive and the mainland underpinned after the latest Chinese PMI data in which Manufacturing PMI printed below estimates but Non-Manufacturing PMI firmly surpassed forecasts and along with Composite PMI, all returned to expansion territory.

Top Asian News

It’s been a downbeat session for global equities thus far as sentiment deteriorates further. European bourses are lower across the board, with losses extending during early European hours. European sectors are all in the red but portray a clear defensive bias. Stateside, US equity futures have succumbed to the glum mood, with the NQ narrowly underperforming.

Top European News

FX

Fixed Income

Commodities

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We’ve just released the results of our monthly EMR survey that we conducted at the start of the week. It makes for some interesting reading, and we’re now at the point where 90% of respondents are expecting a US recession by end-2023, which is up from just 35% in our December survey. That echoes our own economists’ view that we’re going to get a recession in H2 2023, and just shows how sentiment has shifted since the start of the year as central banks have begun hiking rates. When it comes to people’s views on where markets are headed next, most are expecting many of the themes from H1 to continue, with a 72% majority thinking that the S&P 500 is more likely to fall to 3,300 rather than rally to 4,500 from current levels, whilst 60% think that Treasury yields will hit 5% first rather than 1%. Click here to see the full results.

When it comes to negative sentiment we’ll have to see what today brings us as we round out the first half of the year, but if everything remains unchanged today we’re currently set to end H1 with the S&P 500 off to its worst H1 since 1970 in total return terms. And there’s been little respite from bonds either, with US Treasuries now down by -9.79% since the start of the year, so it’s been bad news for traditional 60/40 type portfolios. Ultimately, a large reason for that has been investors’ fears that ongoing rate hikes to deal with inflation will end up leading to a recession, and yesterday saw a continuation of that theme, with Fed Chair Powell, ECB President Lagarde and BoE Governor Bailey all reiterating their intentions in a panel at the ECB’s Forum to return inflation back to target.

In terms of that panel, there weren’t any major headlines on policy we weren’t already aware of, although there was a collective acknowledgement of the risk that inflation could become entrenched over time and the need to deal with that. Fed Chair Powell described the US economy as in “strong shape”, but one that ultimately requires much tighter financial conditions to bring inflation back to target. Year-end fed funds expectations remained steady in response, down just -0.7bps to 3.45%. However, further out the curve the simmering slower growth narrative continued to grip markets and sent 10yr Treasury yields -8.2bps lower to 3.09%, and the 2s10s another -1.1bps flatter to 4.7bps. In line with a tighter Fed policy path and slower growth, 10yr breakevens drove the move in nominal yields, falling -8.2bps to 2.39%, their lowest levels since January, having entirely erased the gains seen after Russia’s invasion of Ukraine, when it peaked above 3% at one point in April. Along with 2s10s flattening, the Fed’s preferred measure of the near-term risk of recession, the forward spread (the 18m3m – 3m), similarly flattened by -5.7bps, hitting its lowest level in nearly four months at 154bps. And thismorning there’s only been a partial reversal of these trends, with 10yr Treasury yields (+1.3bps) edging back up to 3.10% as we go to press. Over in equities, the S&P 500 bounced around but finished off of its intraday lows with just a -0.07% decline, again with the macro view likely skewed by quarter-end rebalancing of portfolios. The NASDAQ was similarly little changed on the day, falling a mere -0.03%.

In terms of the ECB, President Lagarde said on that same panel that she didn’t think “we are going back to that environment of low inflation” that was present before the pandemic. But when it came to the actual data yesterday there was a pretty divergent picture. On the one hand, Spain’s CPI for June surprised significantly on the upside, with the annual inflation rising to +10.0% (vs. +8.7% expected) on the EU’s harmonised measure. But on the other, the report from Germany then surprised some way beneath expectations, coming in at +8.2% on the EU-harmonised measure (vs. +8.8% expected). So mixed messages ahead of the flash CPI print for the entire Euro Area tomorrow.

As in the US, there was a significant rally in European sovereign bonds, with yields on 10yr bunds (-10.7bps), OATs (-10.7bps) and BTPs (-16.0bps) all moving lower on the day. Equities also lost significant ground amidst the risk-off tone, and the STOXX 600 shed -0.67% as it caught up with the US losses from the previous session. That risk-off tone was witnessed in credit as well, where iTraxx Crossover widened +21.5bps to a post-pandemic high. At the same time, there were further concerns in Europe on the energy side, with natural gas futures up by +8.06% to a three-month high of €139 per megawatt-hour, which follows a reduction in capacity yesterday at Norway’s Martin Linge field because of a compressor failure.

Whilst monetary policy has been the main focus for markets lately, we did get some headlines on the fiscal side yesterday too, with a report from Bloomberg that Senate Democrats were working on an economic package that had smaller tax increases in order to reach a deal with moderate Democratic senator Joe Manchin. For reference, the Democrats only have a majority in the split 50-50 senate thanks to Vice President Harris’ tie-breaking vote, so they need every Democrat Senator on board in order to pass legislation. According to the report, the plan would be worth around $1 trillion, with half allocated to new spending, and the other half cutting the deficit by $500bn over the next decade.

Overnight in Asia we’ve seen a mixed market performance overnight. Most indices are trading lower, including the Nikkei (-1.45%) and the Kospi (-0.81%), but Chinese equities have put in a stronger performance after an improvement in China’s PMIs in June, and the CSI 300 (+1.62%) and the Shanghai Comp (+1.31%) have both risen. That came as manufacturing activity expanded for the first time in four months, with the PMI up to 50.2 in June (vs. 50.5 expected) from 49.6 in May. At the same time, the non-manufacturing climbed to 54.7 points in June, up from 47.8 in May, which also marked the first time it’d been above the 50 mark since February.

Nevertheless, that positivity among Chinese equities are proving the exception, with equity futures in the US and Europe pointing lower, with those on the S&P 500 (-0.28%) looking forward to a 4th consecutive daily decline as concerns about a recession persist.

When it came to other data yesterday, the third estimate of US GDP for Q1 saw growth revised down to an annualised contraction of -1.6% (vs. -1.5% second estimate). Separately, the Euro Area’s M3 money supply grew by +5.6% year-on-year in May (vs. +5.8% expected), which is the slowest pace since February 2020.

To the day ahead now, data releases include German retail sales for May and unemployment for June, French CPI for June, the Euro Area unemployment rate for May, Canadian GDP for April, whilst the US has personal income and personal spending for May, the weekly initial jobless claims, and the MNI Chicago PMI for June.

Believe it or not, we’re now at the point where even mainstream media are reporting that COVID-19 is more prevalent among the boosted, compared to those who quit after the initial series. That doesn’t mean that sanity is returning; it’s just interesting that they’re not able to ignore it completely, even though their efforts to rationalize it teeter on the verge of lunacy. June 6, 2022, CBS News reported:1

“As COVID-19 cases began to accelerate again this spring, federal data suggests the rate of breakthrough COVID infections in April was worse in boosted Americans compared to unboosted Americans …

Meanwhile, federal officials are also preparing for key decisions on future COVID-19 vaccine shots … In the short term, CDC Director Dr. Rochelle Walensky recently told reporters that her agency was in talks with the Food and Drug Administration about extending the option for second boosters to more adults.”

If Walensky’s logic makes your brain feel like it’s been beat with a meat mallet, you’re not alone. It’s so beyond irrational as to be inexplicable. If boosters make you more prone to infection, is giving boosters to more people really the prudent answer?

Overall, data from the Centers for Disease Control and Prevention’s new COVID dashboard2 show boosted Americans are catching COVID at nearly twice the rate of the unboosted — a statistic John Moore, professor of microbiology and immunology at Weill Cornell Medical College, attributes to the boosted feeling “more protected than they actually are,” and therefore taking fewer precautions.3

Considering we know that masks, social distancing and lockdowns don’t work to prevent infection spread, Moore’s explanation is flimsy at best. It’s far more reasonable to conclude that the COVID injections are the problem.

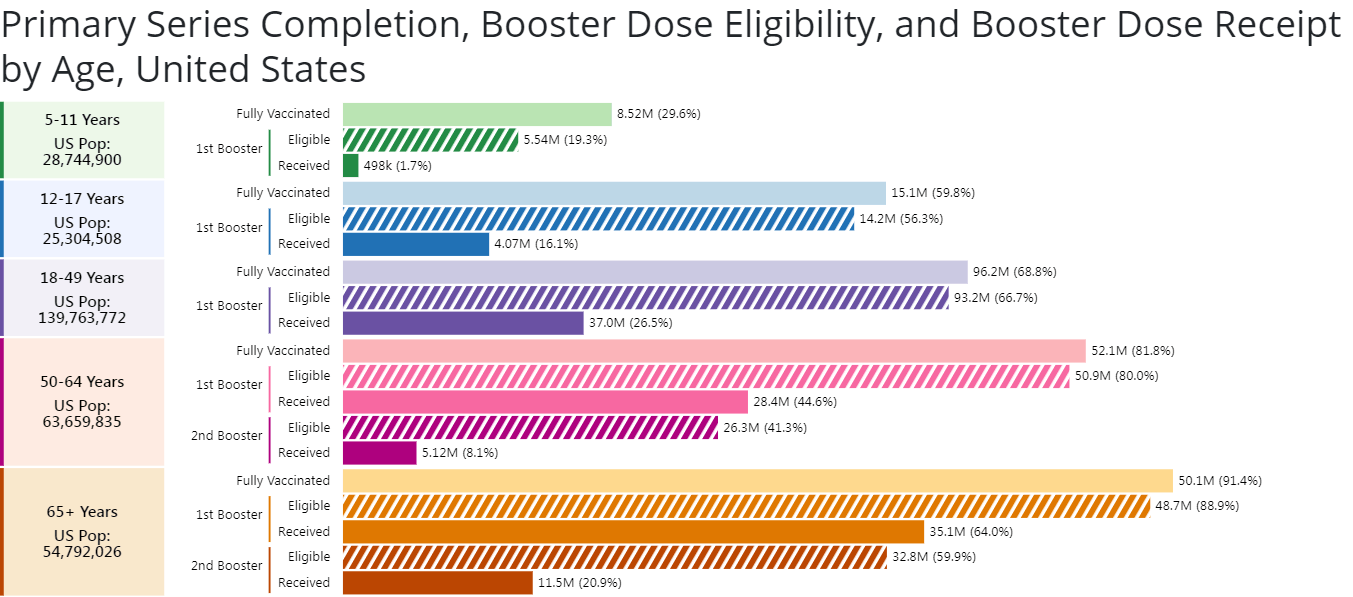

According to the CDC, the unvaccinated still account for a majority of positive COVID tests, at a rate of 188.2 per 100,000 as of April 23, 2022. Those with a primary series plus one or two booster shots are catching the infection at a rate of 119.94 per 100,000, while those with the primary series clock in at a rate of 56.44 per 100,000.

Of course, CBS is careful to note that “The new data do not mean booster shots are somehow increasing the risk” of COVID, but rather that “the shift underscores the growing complexity of measuring vaccine effectiveness at this stage of the pandemic.”4

CBS also misleadingly claims that while the boosted have more than double the rate of infections of the unboosted, it’s still “but a fraction of the levels among unvaccinated Americans.” However, 120 (rounded up from 119.94) is hardly “but a fraction” of 188. At 64% of the unvaccinated rate, using the term “a fraction of” seems like an intentional attempt to downplay just how common COVID is getting among the boosted.

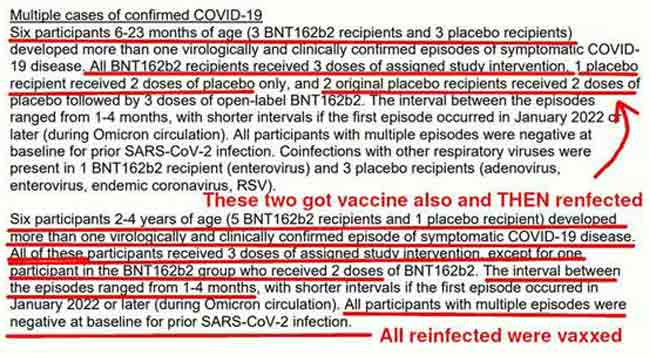

In related news, Pfizer’s pediatric trial reveals the shots raise rather than lower the risk of reinfection (meaning catching COVID more than once).

In his Substack article,5 “Finally Proven: Pfizer Vaccine Causes COVID Reinfection, Disables Natural Immunity,” Igor Chudov — a businessman and mathematician6 — points to the black-and-white data on page 38 of the documentation7 submitted to the FDA for its COVID jab Emergency Use Authorization request for use in children 6 months through 4 years of age. Here’s a screen shot with Chudov’s markings and notes:

In all, 12 of the children in Pfizer’s trial were diagnosed with COVID twice within the follow-up period, which ranged from one to four months. Of those, 11 had received two or three jabs; only one child in the placebo (unvaccinated) group got COVID twice.

“So, what caused vaccinated children to develop a disproportionate amount of repeat infections? The vaccine, of course. It’s a randomized controlled trial, after all,” Chudov writes.8

“Thanks to Pfizer, we finally know that COVID reinfections are real and that their vaccine causes them by disabling natural immunity. A little caveat is that Pfizer made the trial purposely complicated (because it is a resuscitated FAILED trial where they added one more booster dose and more kids).

Pfizer vaccinated the control group. This complication somewhat affects the 6-23-month age category, but still shows obvious vaccine failure. The 2-4-year-old group is much less complicated: all reinfections happened in the vaccinated participants, five of six were from the first-vaccinated group.

‘All of these participants received 3 doses of assigned study intervention, except for one participant … who received two doses.’ We have a smoking gun that reinfections are vaccine driven.”

This post-jab reinfection anomaly has also been stressed by Dr. Clare Craig, a diagnostic pathologist,9 who reviewed some of the most damning data from Pfizer’s pediatric trial in a recent video (below).

Data from Moderna’s trial also suggest the shot makes adults more prone to repeat infections, thanks to an inhibited antibody response. A preprint study10,11 posted on medRxiv April 19, 2022, found adult participants in Moderna’s trial who got the real injection, and later got a breakthrough infection, did not generate antibodies against the nucleocapsid — a key component of the virus — as frequently as did those in the placebo arm.

Placebo recipients produced anti-nucleocapsid antibodies twice as often as those who got the Moderna shot, and their anti-nucleocapsid response was larger regardless of the viral load. As a result of their inhibited antibody response, those who got the jab may be more prone to repeated COVID infections.

These findings are further corroborated by data from the U.K. Health Security Agency. It publishes weekly COVID-19 vaccine surveillance data, including anti-nucleocapsid antibody levels. The report12,13 for Week 13, issued March 31, 2022, shows that COVID-jabbed individuals with breakthrough infections indeed have lower levels of these antibodies.

Another crucial piece of information that Craig highlights in her video is that of the 4,526 children enrolled in the trial, a whopping 3,000 dropped out. Pfizer does not explain this highly suspicious anomaly. Oftentimes, trial participants will drop out when side effects are too severe for them to continue.

Drug companies will also sometimes exclude participants who develop side effects they’d rather not divulge. This is one of those nasty loopholes that can skew results. Here, we don’t know why two-thirds of the participants were eliminated, and “on that basis alone, this trial should be deemed null and void,” Craig says. Pfizer’s pediatric trial data also show that:

• Six of the children, aged 2 to 4 years, in the vaccinated group were diagnosed with “severe COVID,” compared to just one in the placebo group. So, the likelihood the shot is causing severe COVID is higher than the likelihood that it’s preventing it.

• The only child who required hospitalization for COVID was also in the “vaccinated” group.

• In the three weeks following the first dose, 34 of the children in the vaccinated group and 13 of the unvaccinated children were diagnosed with COVID. That means the children’s risk of developing symptoms of COVID within the first three weeks of the first dose actually increased by 30%. These data were ignored.

Between doses two and three, there was an eight-week gap, and the vaccinated arm again experienced higher rates of COVID. This too was ignored. After the third dose, incidence of COVID was again raised in the vaccine group, and this was ignored as well.

In the end, they only counted three cases of COVID in the vaccine arm and seven cases in the placebo group. They literally ignored 97% of all the COVID cases that occurred during the trial to conclude that the shots were “effective” in preventing COVID.

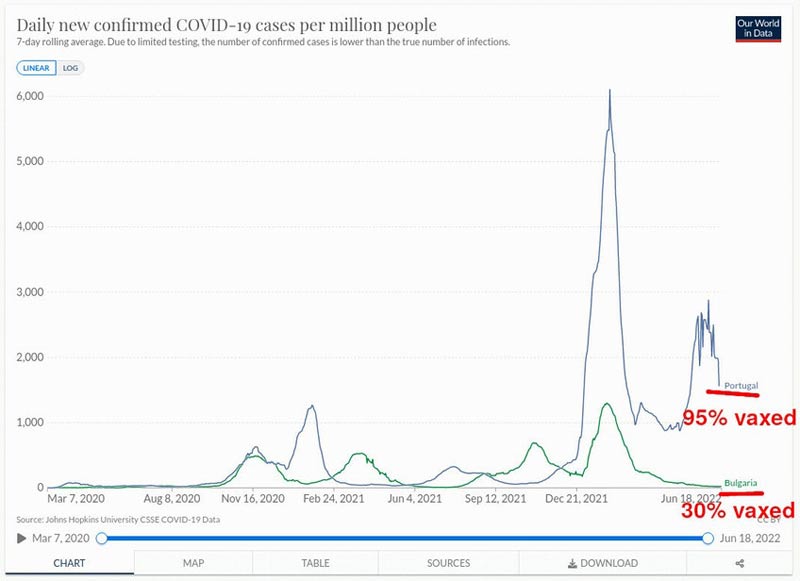

There’s really no shortage of evidence indicating the COVID shots are a complete failure and should be stopped immediately. One example I haven’t reviewed in previous articles is the difference between Portugal and Bulgaria.

In his article, Chudov14 presents the following graph from Our World in Data, which shows the rate of new COVID cases in these two countries. The vaccination rate in Portugal is 95%, whereas Bulgaria’s is 30%. Guess which country has the higher COVID case rate? The graph speaks for itself.

In mid-June 2022, The Times of Israel also reported15 a sudden 70% spike in seriously ill COVID patients from one week to the next. According to Reuters’ COVID data tracker,16 Israel has administered enough doses to vaccinate 100.4% of its population with two doses, so it has one of the highest vaccine uptake rates in the world.

Despite a significant increase in antibodies after the fourth vaccine, this protection is only partially effective against the Omicron strain, which is relatively resistant to the vaccine. ~ Professor Gili Regev-YochayIn mid-January 2022, Israel reported17 a fourth dose (second booster) was “only partially effective” against Omicron. Lead researcher, professor Gili Regev-Yochay, told reporters, “Despite a significant increase in antibodies after the fourth vaccine, this protection is only partially effective against the Omicron strain, which is relatively resistant to the vaccine.”

The latest spikes in both Israel and Portugal are being blamed on a new variant mutated from Omicron, referred to as BA.5.18 According to The Times of Israel,19 coronavirus czar Dr. Salman Zarka said “the new variant BA.5 is quickly gaining traction and is more resistant to vaccines than previous strains.” So, what’s Israel’s answer? More shots to encourage “herd immunity” and more mask wearing.

An analysis of the Omicron wave in Qatar is also illustrative of vaccine failure. June 21, 2022, The Epoch Times reported20 on the study,21 published the week before in the New England Journal of Medicine. In summary:

Though the authors’ conclusion was that there were “No discernable differences in protection” between vaccination and natural immunity, ask yourself which you would rather have: 50% immunity for at least 10 months, or 50% immunity for about six months followed by an increased risk of infection (negative protection) thereafter?

Clearly, if your goal is to avoid infection, you would avoid anything that will — immediately or in the future — raise your risk. Yet, in the upside-down world we now find us in, the answer continues to be: “Get another shot.”

As discussed in “FDA and Pfizer Knew COVID Shot Caused Immunosuppression,” Pfizer’s trial data also reveal they’ve not ruled out the risk of antibody-dependent enhancement, and vaccine-associated enhanced disease (VAED) is listed22 as an “Important Potential Risk.” (ADE and VAED are two terms that basically refer to the same thing — worsened disease post-injection.)

So, not only are you at increased risk of COVID infection, and repeated reinfections, if you get the jab — especially if you get boosted — but you may also experience more severe illness, which is the opposite of what anyone would want. U.K. government data show that, compared to the unvaccinated, those who have received two doses are:23

In closing, it’s clear there are no long-term benefits to the COVID jabs, only risk. How much more data do we need before our health agencies snap to and start protecting public health?

I don’t have an answer to that question, seeing how nothing works the way it’s supposed to anymore. Our health agencies have been captured by the drug industry and have basically gone rogue. They ignore even the most basic rules and ethics nowadays.

Something will clearly need to be done about that, but until then, the best advice I have is to take control of your own health and make decisions based on actual data rather than corporate press releases.

If you’ve already taken one or more COVID jabs and now regret it, first, the most important step you can take is to not take any more shots. Next, if you suspect your health may have been impacted, check out the Frontline COVID-19 Critical Care Alliance’s (FLCCC) post-vaccine treatment protocol, I-RECOVER,24 which you can download from covid19criticalcare.com in several different languages.