Welcome To The Recession: Atlanta Fed Slashes Q2 GDP To -1%, Pushing First Half Into Contraction

A day after Fed Chair Powell crowed once again how the US economy was strong enough to cope with his hawkish rate-hike cycle (and President Biden told the world this morning that the US economy is the strongest in the world), the Atlanta Fed just stole the jam out of everyone's donut by confirming the recession has started.

If you were curious why bond yields are plunging and rate-hike expectations are falling, then here's your answer, courtesy of the Atlanta Fed, which just confirmed the economy is in technical recession.

I may be the only person besides Jay Powell who believes we are not going to have a recession. At least i hope Jay thinks that way!

— Jim Cramer (@jimcramer) June 3, 2022

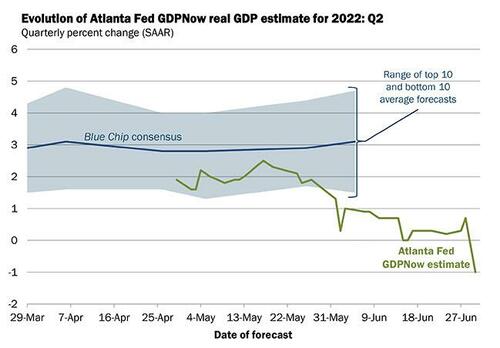

The continued erosion in economic data has prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from 0.0% to -1.0%+0.9% to 0.0%, meaning the US is now right on the verge of a technical recession (after Q1's confirmed 1.6% contraction yesterday).

According to the Atlanta Fed's GDPNow model estimate for real GDP, growth in the second quarter of 2022 has been cut to a contractionary -1.0%, down from 0.0% on June 15, down from +0.9% on June 6, down from 1.3% on June 1, and down from 1.9% on May 27.

As the AtlantaFed notes, "The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.0 percent on June 30, down from 0.3 percent on June 27. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 2.7 percent and -8.1 percent, respectively, to 1.7 percent and -13.2 percent, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth increased from -0.11 percentage points to 0.35 percentage points."

In short: the US consumer is getting tapped out, just as we have been warning repeatedly.

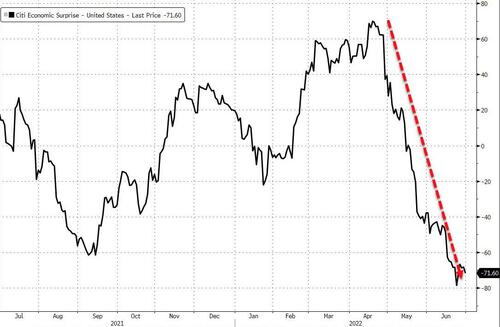

Which also fits with Jamie Dimon's recent "downgrade" of the economy from "storm clouds" to "hurricane"... and also makes some sense given the recent collapse in macro data relative to expectations...

And longer-term, the trend towards stagflation could not be clearer...

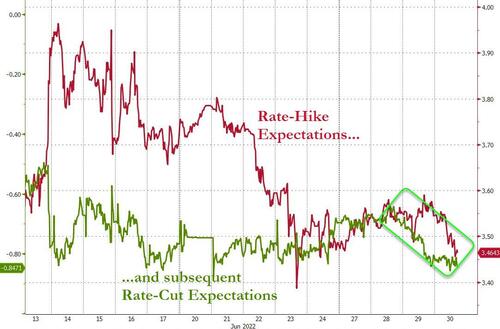

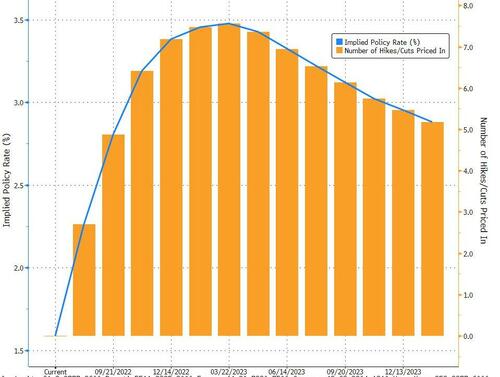

And this is increasingly problematic for The Fed, as the market is now betting Powell and his pals won't get close to hiking as much as they hope...

And in fact the market is now expecting rate-cuts to start in Q1 2023...

Will The Fed adjust to the market once again?

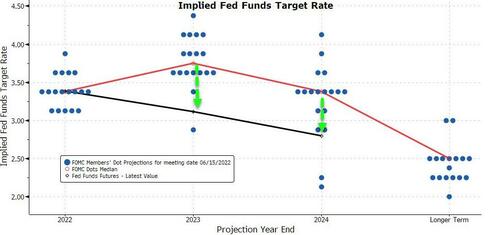

Meaning The Fed is now hiking rates into a recession...

Today https://t.co/MmfB76vWpB

— zerohedge (@zerohedge) June 30, 2022

...and the market is already pricing in more than 3 rate-cuts to address that recession.

Get back to work Mr.Powell.

via IFTTT

InoreaderURL: SECONDARY LINK