Here Is The Real April Jobs Report: 42 Million Unemployed, 25.5% Unemployment Rate

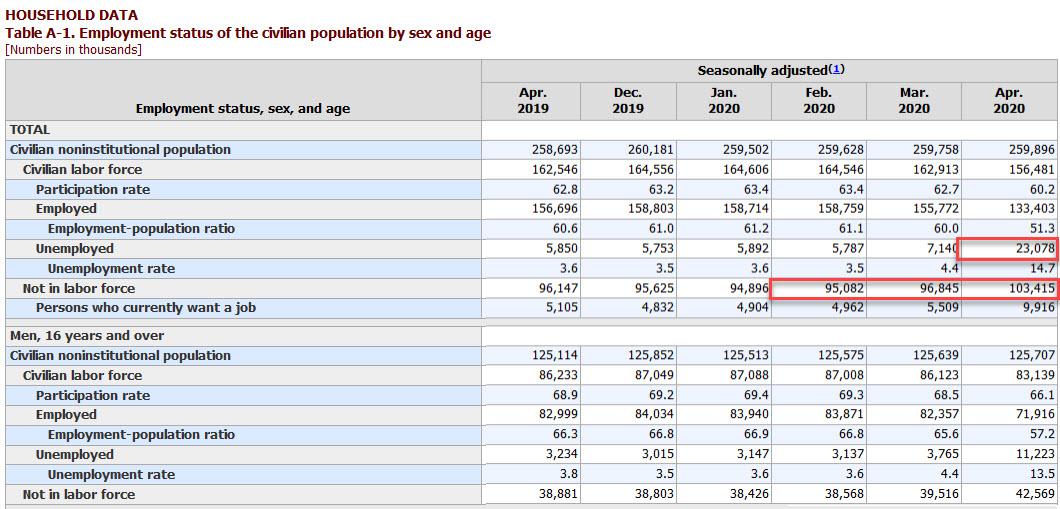

Friday's job report - according to which a record 20.5 million jobs were lost in April, some 10x more than the depths of the Great Depression, resulting in a 14.7% unemployment rate - was ugly enough as is, the NYT summarizing the catastrophic nature of the economic collapse with the following creative front page.

The truth, unfortunately is even uglier.

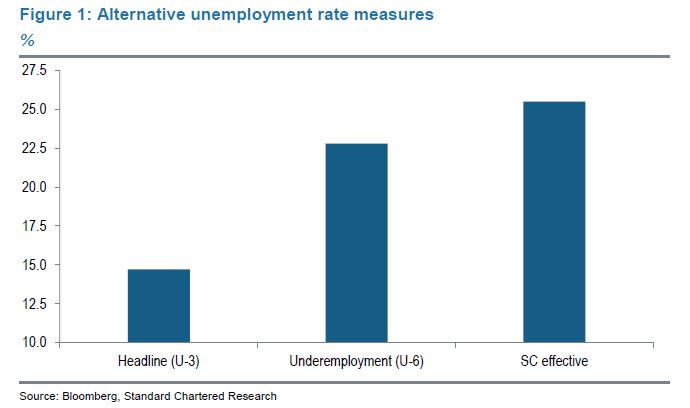

While it is true that what the BLS reported that the April unemployment rate (UR) was less than expected (14.7% versus consensus of 16.0%) and the drop in payroll employment of 20.5 million was also less than the 22.0 million expected, Standard Chartered bank has calculated that adjustments to the headline unemployment rate push the effective number of unemployed to 42 million and the effective UR rate to 25.5%, higher even than the U-6 underemployment rate of 22.8%. Worse, if one treats underemployed in line with the U-6 methodology, the true April unemployment number would rise to an mindblowing 27.5%.

How does one get these numbers? As the bank's chief FX strategist Steve Englander explains, start with the 23.1 million unemployed as published by BLS. To this add 8.1mn people who have dropped out of the labor force since February (previously the labor force had been growing steadily, so these are likely unemployed).

Add back 7.5MM workers classified as ‘employed but not at work for other reasons’ – BLS states that these workers are likely misclassified as employed, when they are in fact unemployed. Involuntary part-time work for economic reasons has gone up by 6.6MM and we treat these as half-unemployed (i.e., a contribution of 3.3MM).

This totals almost 42 Million effectively unemployed. Keep the civilian labor force denominator at February’s 164.5 million, which results in a 25.5% estimate for effective unemployment, and if Englander treated involuntary part-time workers as completely unemployed, the resulting unemployment rate would be at 27.5%.

Commenting on the April BLS report, Englander writes that "bad data for the mid-March to April period is largely anticipated by investors; these data were neither good nor bad enough to force investors to adjust expectations." He also expects the May labor data to show deterioration at a slower pace, but think that investors are looking at the balance between initial and continuing claims to assess the pace at which reopening would lead to better labor-market outcomes.

And while a slowdown in the collapse is to be expected - after all, there are only so many workers that can be fired - don't expect it any time soon. As we first noted on Friday, White House economic adviser Kevin Hassett - who said two weeks ago that Q2 GDP would be the biggest negative number since the great depression - has set the groundwork for an even scariee number next month as the statistics catch up to the reality, warning that unemployment could hit 20% in May, up from 14.7% in April, or rather down from the real 27.5% unemployment rate.

"I think just looking at the flow of initial claims, it looks like we're probably going to get close to 20 percent in the next report ," Hassett told CNN's "State of the Union" on Sunday, refusing to admit that the actual number when one eliminates the BLS fudges is already far higher.

He added that the rate will depend on whether the virus "has really abated" and if economies are "really going again."

"I would guess middle of summer is when we’re going to start to go into the transition phase," said Hassett, adding that he hopes the third and fourth quarters will bring "very strong" growth.

“Just looking at the flow of initial claims that it looks like we’re probably going to get close to 20% in the next report,” senior White House economic adviser Kevin Hassett says about US unemployment. #CNNSOTU pic.twitter.com/bTN85AJaMD

— State of the Union (@CNNSotu) May 10, 2020

Looking ahead at the May data, Englander is similarly gloomy and warns that initial claims have totaled 7 million since the April survey week and there is no sign that continuing claims are turning down due to rehiring or reopening, adding that "at this point it does not look like May employment data will show improvement or even stability."

The incoming data look consistent with the baseline UR breaching 20% in May, especially if the responses on "employed but not at work for other reasons" change.

In summary, the Trump admin is hoping that within a few months the bottom will be in for the economy, it is also hoping that the official government reports eventually catch down to reality, and that at some point the two series - the actual economy and how the government actually represents it - will converge. The question is when, and just how massive the discrepancy between truth and the "official data" will grow until that happens.

via IFTTT

InoreaderURL: SECONDARY LINK