The Housing Debt Bubble Is Going To Burst Tyler Durden Thu, 11/12/2020 - 13:00

Authored by Patrick Hill via RealInvestmentAdvice.com,

The $100B+ Housing Debt Bubble Is Going To Burst

“Being self-employed, I don’t like to add extra bills or burdens, and with a moratorium, there’s no guarantee that later I won’t be further into debt.”

- Lucy, freelance photographer, Colorado – July 2020

Lucy’s concern about accumulating debt echoes across America. Millions of renters and homeowners are anxious about paying both their monthly housing bill and a ballooning debt balance.

Based on present missed payment rates, consumers will accumulate at least $100B in housing debt by January 2021. The following model describes a set of linked health, social and economic events. These events are likely to unfold in next 6 months. An uncontrolled wave of virus infections drives the cascading economic impact:

Virus growth uncontrolled > economic activity contracts > unemployment rises

> personal income falls > consumers miss rent and mortgage payments

> rent and mortgage payment moratoriums fail > consumers use credit cards to make payments

> small business apartment landlords & homeowners default on mortgages (debt bubble bursts)

> consumer spending dives

Our analysis starts by examining the virus 3rd wave and a likely increase in lockdowns.

Virus Growth Uncontrolled

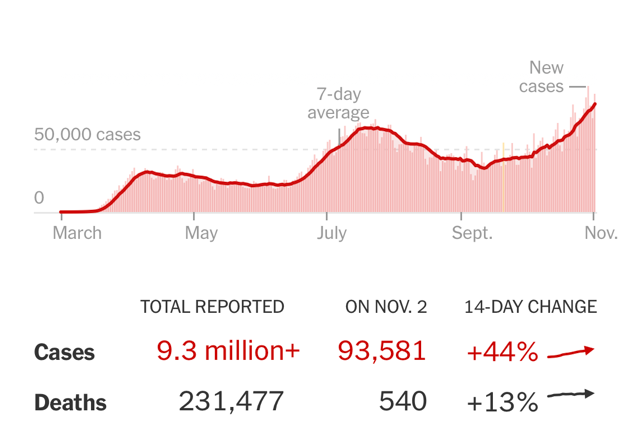

On November 2st the U.S. had a 44% increase in daily COVID-19 to 93,581. The chart below indicates the second wave of infections did not decline to the first wave low. Thus, experts forecast a third winter wave peak of cases will be higher than the second spring wave peak.

Source: New York Times – 11/3/20

Hospitalizations are rising in 42 states. Nineteen states report their highest hospitalization rate since the pandemic began in March. Uncontrolled virus infections will result in more partial or full lockdowns of intense social activity businesses including, hotels, restaurants, bars, theaters, sports stadiums, indoor arenas, offices, transit, airlines, hair salons, and personal services. An indication of what the U.S. may face soon is unfolding now in the United Kingdom, Germany, and France. These EU countries are tightening pandemic restrictions at levels not seen since last June. Meantime, U.S. businesses, such as internet entertainment, technology services, eCommerce and, socially distanced grocery stores, will continue to grow.

Economic Activity Contracts

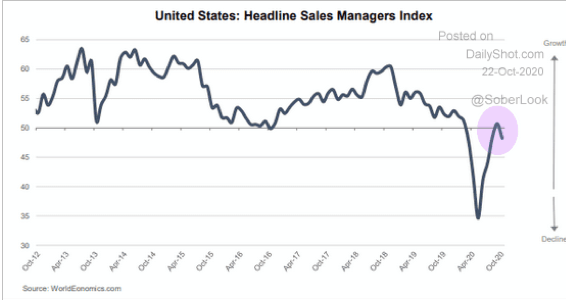

The U.S. Economy is contracting according to the latest Sales Manager Index. The next chart shows a U.S. Sales Manager survey of national economic activity jumping in the 3rd quarter and then rolling over into contraction.

Source: World Economics, The Daily Shot – 10/22/20

Components of the Sales Manager Index that are falling or flat include business confidence contracting, market growth flat, sales growth flat, profit margins weakening, and staffing levels falling. Accordingly, staffing levels are critical to watch as more layoffs mean an increase in unemployment.

Unemployment Rises

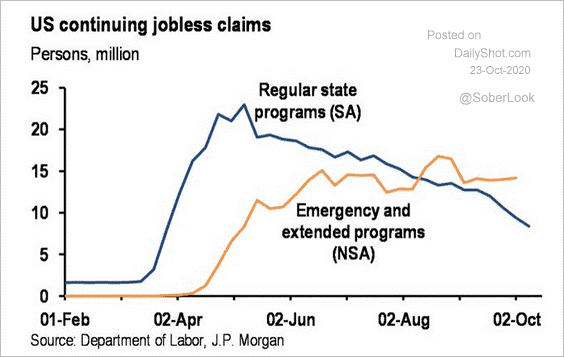

The latest report from the Department of Labor for state unemployment claims and continuing benefits shows a high level of unemployment continuing. The trend chart below shows that while regular state benefits are declining, extended emergency benefits increase for long-term jobless workers.

Sources: Department of Labor, J.P. Morgan, The Daily Shot – 10/23/20

There are 22.6M workers on continuing unemployment assistance. This level of continuing unemployment is 22 times the level of 1M a year ago. Considering 2 -3M workers who have not qualified for extended benefits or have used up their extended benefits the number of eligible workers for unemployment is closer to 25 – 26M. Twenty-six million workers unemployed is about 17.3% of the labor force. Labor experts set the unemployment rate at 20% if other workers who did not apply for benefits are added. High unemployment rates are driving personal income down.

Personal Income Falls

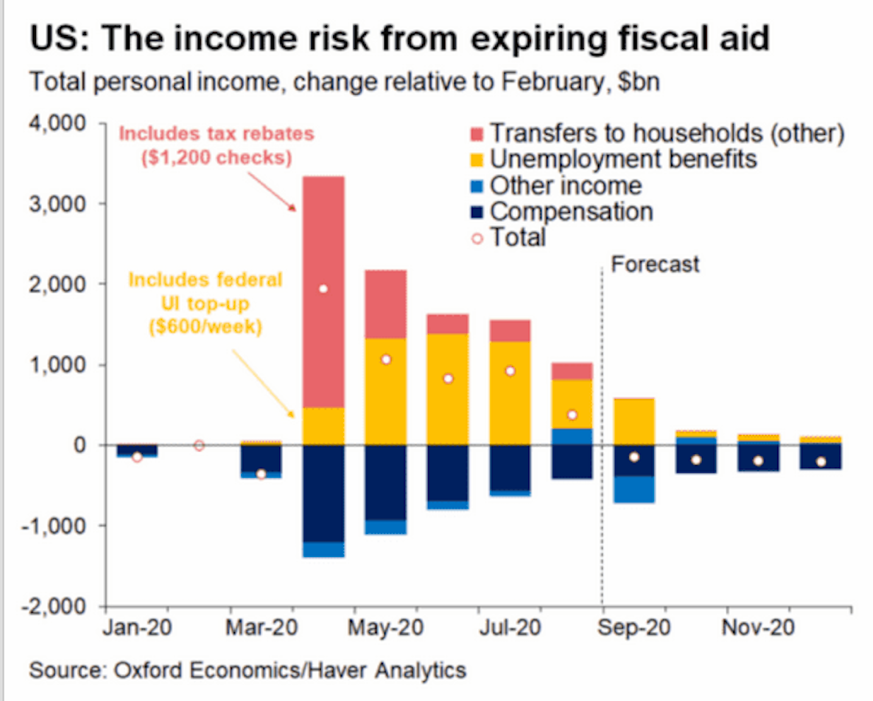

Consumer personal income received a boost from several sources. The CARES Act provided $1,200 stimulus checks, enacted the Payroll Protection Program targeting small businesses, a $600 weekly increase in unemployment insurance, and other emergency loans. The following Oxford Economics analysis indicates that a budget squeeze began in October.

Sources: Oxford Economics, The Daily Shot – 10/8/20

Oxford forecasts that household income will fall by 3% below pre-COVID levels beginning in November. The model shows how tight household budgets will become by January 2021.

Consumers Miss Rent and Home Mortgage Payments

The Mortgage Bankers Association reports for the 2nd quarter of 2020 rental income losses of $9.1B and mortgage payments missed of $16.3B. For the 3rd quarter, rental losses were $9.1B and $19.4B in missed mortgage payments. For the 4th quarter, we forecast a continuing $35B total for both missed rental income and mortgage payments. The total forecast for both rental income losses and missed mortgage payments by 2021 is $90B.

However, Moody’s Analytics forecasts $70B in missed rental payments alone by 12.8M renters by January 2021. Confirming the 12.8M figure, a study by Joint Center For Housing Studies at Harvard reports that 12.1M renter households have at least one at-risk-industry worker. Due to the wide variance in estimates, we forecast at least $100B in rental and mortgage debt due in January 2021.

Our forecast of $100B in looming housing debt builds on our earlier analysis in a recent Executive – Employee Catch 22 post. In that post we identified two consumer segments, workers and professionals. We noted all homeowners reported no-confidence in making next month’s payment. The analysis indicates that 16% of professional homeowners reported little or no-confidence in making mortgage payments for September. Yet, workers reported twice the no-confidence rate of professionals at 34%.

Rent and Mortgage Moratoriums Fail

The CARES Act mortgage and rent moratorium covered homes and apartment buildings secured with federal loans through July 31st. Renters obtained payment relief, while landlords continued to pay mortgage loans from their funds or relief act assistance. In mid-August, President Trump signed an executive order instructing the Centers for Disease Control and Prevention to identify households where infections may increase and mandate that household members be protected from eviction to ensure public safety. Since the federal moratorium ended and the CDC policy has been put into effect, thousands of landlords have filed suits challenging the CDC authority to protect renters from eviction.

Courts in some states are finding in favor of landlords causing evictions to rise. Moody’s Analytics forecasts that 16% of all renters will face eviction by January 2021. States like California and Washington passed blanket rent moratoriums in effect until January 1st, 2021. Rent debt is not erased in any case. The California moratorium calls for landlords to receive 25 % of the debt balance in January and 50% in February, followed by 25% increments to zero. With no stimulus assistance to renters and distressed homeowners, housing debt will likely continue to soar.

Consumers Use Credit Cards To Make Payments

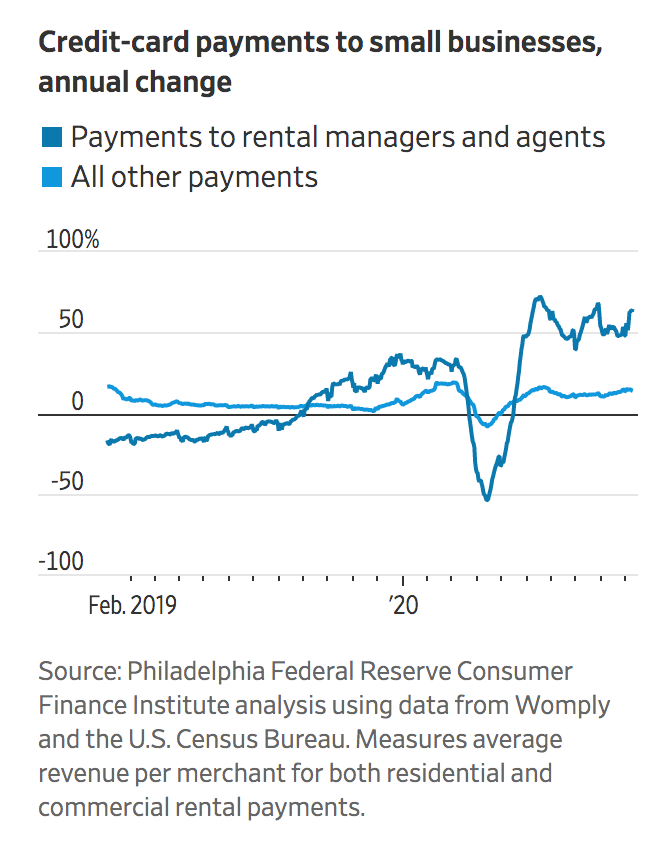

Credit card usage by renters increased by 70% last spring. As renters received stimulus payments, the rate dipped to 50%. However, the credit card payment rate has risen to 65% due to the end of stimulus assistance.

Sources: The Philadelphia Federal Reserve, Census Bureau, The Wall Street Journal – 10/27/20

Consumers building credit card debt while unemployed or on reduced income assistance is unsustainable. Many consumers will be unable to make their credit card payments. Defaulting on their credit cards will hurt their credit score and make it more difficult to obtain other housing because they have an eviction record. A surge in credit card defaults will increase losses for credit card issuing banks as well. Today, missed rent payments force millions of small business landlords to fall behind in their mortgage payments.

Small Business Landlords Default on Mortgages

When renters miss payments, their landlords must continue to pay the mortgage on their building. Property corporations with access to low-interest bank loans or bond markets will have a cushion during this rent loss period. However, many small business landlords are financially stressed. Small business landlords own 22M properties, which are usually 1- 4 unit buildings Local small unit landlords finance their purchases with savings, other business profits, or family and friends. Only 12% of small unit buildings were covered by the CARES Act rent moratorium, which ended on July 31st. So, some small business landlords have taken action to evict tenants.

Facing a cash flow crunch, anxious small business landlords applied for CARES Act business emergency loans to mitigate income loss. The Terner Center for Housing Innovation at UC Berkeley survey of small business landlords found 40 % of owners are not confident they can pay operating costs over the next few months. So, small business landlords may evict tenants to find a paying renter. However, by 1st quarter of 2021, there are likely to be millions of people evicted or with poor credit so, finding another paying tenant could be problematic. Small business landlords facing declining income and poor prospects for new paying tenants will likely default on their mortgage. There is likely to be a surge in multi-unit buildings for sale, causing a decline in multi-unit building construction.

Home Owners Default on Mortgages

Homeowners enter into forbearance plans with their lenders to avoid penalties and fees when they are likely to be delinquent on their payments. Black Knight reports there are 3M mortgages in forbearance as of October 31st. This forbearance rate is ten times the 300k mortgages in forbearance in February of 2020. Most of these mortgages are approaching their six-month renewal date from last March and April. Homeowners can apply for a six-month renewal under the CARES Act. However, after March 2021, the forbearance period ends, and homeowners must begin paying their balance owned while continuing monthly payments.

Eighty percent of present forbearance payers have applied for a six-month extension. With unemployment increasing and lockdowns forecast, there may be an increase in the number of forbearance plans. Other homeowners who don’t qualify for forbearance are delinquent in making payments. Mortgage delinquencies outside of forbearance are up by 107% YTD as of October. By the end of 1st quarter, 2021 defaults are likely to rise significantly.

Consumer Spending Dives

A perfect economic storm is gathering strength from the health, social and financial forces we have identified in this post. The corona virus continues to penetrate all facets of American life, driving uncertainty in the economy. Until we have a national virus containment program implemented, the pandemic will force economic activity down. Without a stimulus package from Congress, millions of unemployed workers, renters, and small businesses will struggle. With the bottom 80% of consumers facing severe economic headwinds, consumer spending will likely dive in the first half of next year.

For investors, this is the time to prepare for a possible severe economic storm coming this winter. Scott Minerd, Global CIO at Guggenheim, observes that we have a pause now giving us time to prepare for an economic whirlwind:

“the relative calm we feel in the markets right now isn’t the end of the storm, it is just the eye, it may seem like there is no storm at all…yet the worst is yet to come.”

* * *

Patrick Hill is the Editor of The Progressive Ensign, https://theprogressiveensign.com/ writes from the heart of Silicon Valley, leveraging 20 years of experience as an executive at firms like HP, Genentech, Verigy, Informatica, and Okta to provide investment and economic insights. Twitter: @PatrickHill1677, email: patrickhill@theprogressiveensign.com

via IFTTT

InoreaderURL: SECONDARY LINK