"People Are Nearing Rock Bottom": Fed's COVID Response Rewards Wealthy While Brutalizing Nation's Poorest

Newsflash: Federal Reserve policy is making the rich much richer.

Certainly that's not something we need to harp upon for most of our readers, who understand exactly how the Fed printing trillions of dollars over the course of months has further bifurcated the wealth gap in the United States. But, what is worthy to point out is that the mainstream media now appears to be getting wise to the concept - and all it took to realize what was going on was billionaires reaping another collective $1.3 trillion while the rest of the country suffered from agonizing depression.

For example, over the weekend, Bloomberg published a piece called "The Rich Are Minting Money in the Pandemic Like Never Before". The sub-heading of the article simply said: "Country’s most well-off benefit from Federal Reserve policies".

The report wonders how it is possible that some people are struggling for food, shelter and jobs while the rich cash in. "It's a difficult thing to fathom," the piece starts, but "there’s a whole class of people -- at least the top 20% or so of earners -- who’ve had to worry little about such matters."

Clearly, the report's authors don't read Zero Hedge - because it's not that difficult to fathom. In fact, it's been going on for decades.

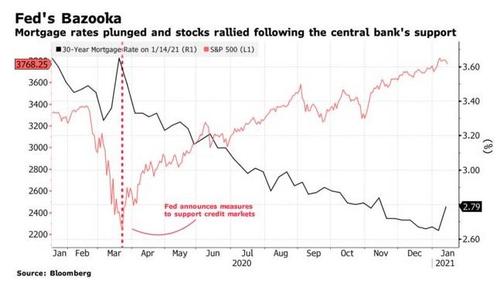

The report goes on to note how mortgage refinancing, working from home and the stock market has helped along the "haves" while the "have nots" continue to struggle. These wealth gains "obscure" the plight of the middle and lower class, which has seen hundreds of thousands of businesses shut down and more than 10 million unemployed.

Peter Atwater, an adjunct professor at William & Mary, said: “There has probably not been a better time to be wealthy in America than today. So much of what policy makers did was to enable those that were wealthiest to rebound fastest from the pandemic.”

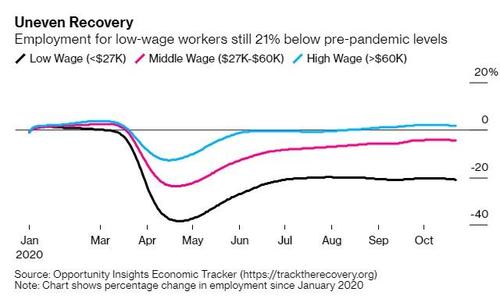

Employment for the bottom quartile of workers, making less than $27,000 per year, remains 20% lower than January 2020 levels. 30 million adults lived in households where there wasn't enough to eat, according to the report - up 28% since prior to the pandemic. In Louisiana, 1 in 5 citizens faces food scarcity.

Meanwhile, employment for the top quartile of workers earning over $60,000 per year has "already recovered to levels from a year ago". Many of Americans were also able to redirect money they would have used on entertainment and travel to savings and investments. Thanks to the Fed, these types of redirections have paid off well.

Hilariously, Bloomberg places blame on the bifurcation to "challenges" regarding money distribution: "By easing credit conditions via the Fed, lawmakers were able to quickly prop up large corporations and wealthier individuals. But distributing aid to smaller firms and low-income workers has turned out to be a lot more challenging." But, the truth is that it isn't more challenging - the Fed and the government choose to distribute newly printed money disproportionately. The government doesn't seem to understand the problem and the Fed simply doesn't seem to care.

Jerome Powell said in December: “The Fed cannot grant money to particular beneficiaries. Elected officials have the power to tax and spend and to make decisions about where we, as a society, should direct our collective resources.”

Amanda Fischer, policy director at the Washington Center for Equitable Growth, commented: “If your wealth is captured by financial assets, you were back up and running in no time. It’s the lowest income folks who don’t even have to file taxes that have the highest barrier to climb.”

She continued, alluding to what sounds like eventual direct payments from the Fed: “Congress did a pretty good job of getting money to people, but we didn’t manage to fix decades of rusted plumbing. The fact that the Fed has infrastructure to do a bond-buying program but not do to anything else is a choice, not an inevitability.”

Heidi Shierholz of the Economic Policy Institute said: “Without more aid they will have to make more cuts, and cut services and that will disproportionately affect lower income families and communities. You cannot have a sustainable economy and political system where you have a small population who believe they are invincible and a growing population who feel defeated. It’s in capitalism’s best interest to close this gap.”

And while it does sound a bit like more socialism on top of socialism, she isn't terribly wrong about the idea of at possibly returning to some semblance of normalcy by attempting to close this gap and right some wrongs that have been perpetrated by the Fed over the last several decades, before turning things back over to the free market.

But time is not on the side of the middle and lower class. Bradford Botes, a principal at bankruptcy law firm Bond & Botes in Birmingham, said: “People simply feel that they are nearing or at rock bottom. We are hearing a lot more hopelessness. [Stimulus] money was used by people just to get by. The additional stimulus has not been sufficient to make any type of difference for average Americans.”

via IFTTT

InoreaderURL: SECONDARY LINK