Mood On Wall Street Has Never Been More Apocalyptic; Tech Short Is Biggest Since 2006

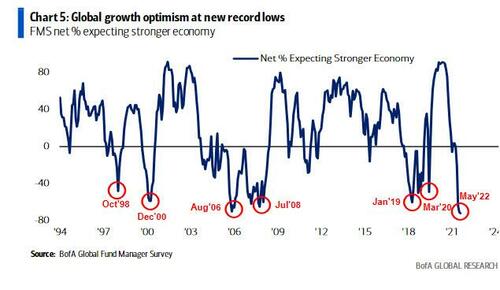

One month after the April Fund Manager Survey was downright "apocalyptic" with the majority seeing a bear market and stagflation - yet nobody rushing to sell - and with optimism plunging to levels right before Lehman, today Bank of America published the latest, May FMS (available to pro subscribers in the usual place) in which the bank's doom-and-gloomy Chief Investment Strategist Michael Hartnett (who most recently warned that the bear market will end when the S&P hits 3,000 in October) found that his view is shared by a growing number of even more apocalyptic Wall Street professionals, because the survey which polled 331 panelists managing $986 billion in AUM, revealed global growth expectations plunged even more compared to last month, and dropped to fresh all-time lows (net -72%) ...

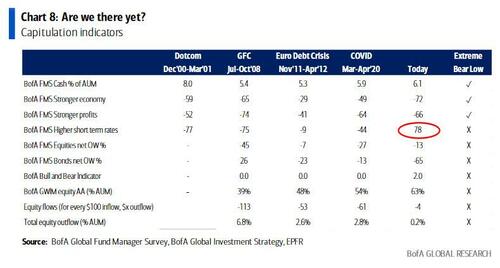

... with profit expectations slumping past the COVID lows to net -66% (from 63%), the weakest since Oct’08, smack in the middle of the Global Financial Crisis. (note lows in global profit expectations consistent with other crisis moments such as LTCM, Dotcom bubble burst, Lehman bankruptcy, and COVID)...

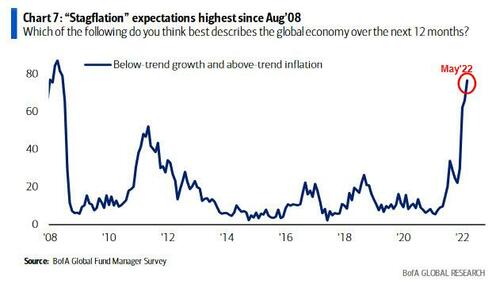

... and stagflation fears soaring to 77% (from 66%) the highest since August 2008.

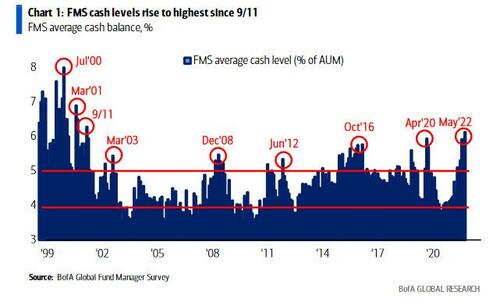

And while the mood has rarely been more pessimistic, with the FMS signaling the highest cash levels in 20 years, since Sept 11, indicative of major risk aversion...

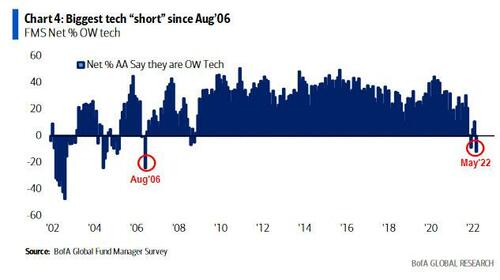

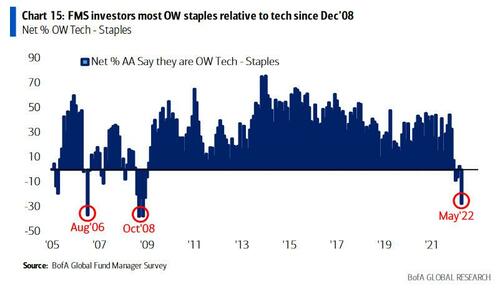

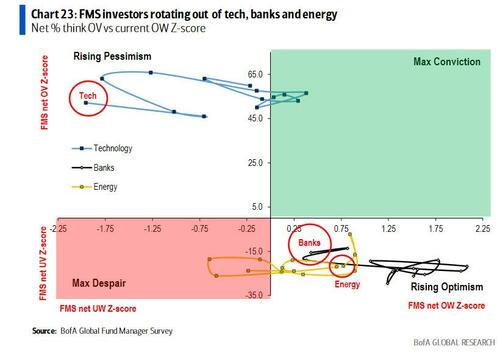

... as Wall Street finds itself most short tech - everyone's darling sector as recently as 2021 - since Aug 2006...

... as a big rotation out of tech drives the relative investor overweight in tech vs staples (really underweight) to Oct 2008 lows...

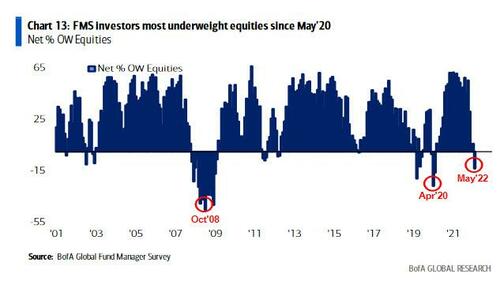

.... sparked by the biggest equity underweight since May 2020 (at net 13% UW vs net 6% OW in Apr)....

... and a BofA Bull & Bear Indicator at 2.0, just on the verge of the 'contrarian buy" level, which would give a brief all-clear window to buy, we are still missing what Hartnett calls the "full capitulation" piece.

As such, while stocks are prone to imminent bear rallies - like today for example- but as Hartnett writes echoing what he said in his latest Flow Show note last Friday, "the ultimate lows have not yet been reached" as investors expect rate hikes not cuts.

Digging deeper into the FMS survey, we first find that even Wall Street is urging corporations to ease back on the buybacks (and CapEx spending, but nobody really spends on CapEx) and investors want CEOs to improve balance sheet not spend capex or buybacks for 1st time since Jan’21.

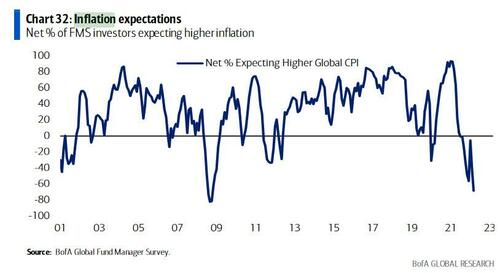

The next part came as a surprise to us, because it confirms that peak inflation is now consensus: that's because 68% expect inflation rates to drop coming quarters...

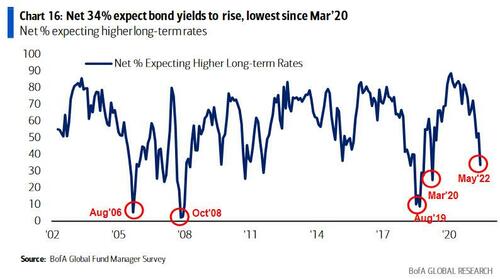

... with fewer and fewer (net 34%, down from 53% in April) expect bond yields to rise from here (but big difference with prior “big lows” Is 78% expect short rates to rise)...

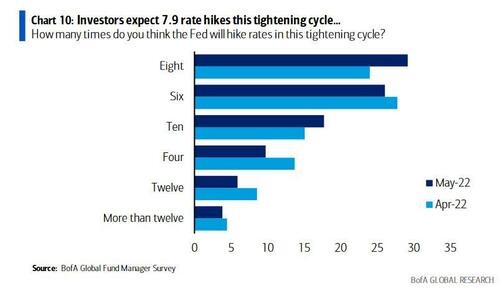

... as investors still expect a total of 7.9 Fed hikes this cycle (up from 7.4 in April).

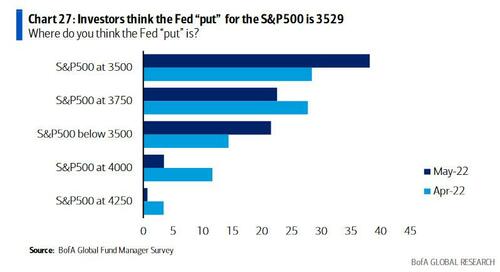

There was less surprise in the latest monthly estimate of where the Fed "put" is: it slid again (along with the market), dropping to 3529 on S&P500 (-12% from current levels).

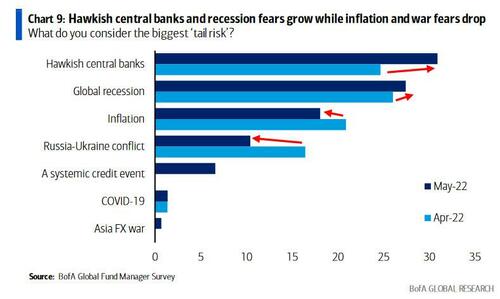

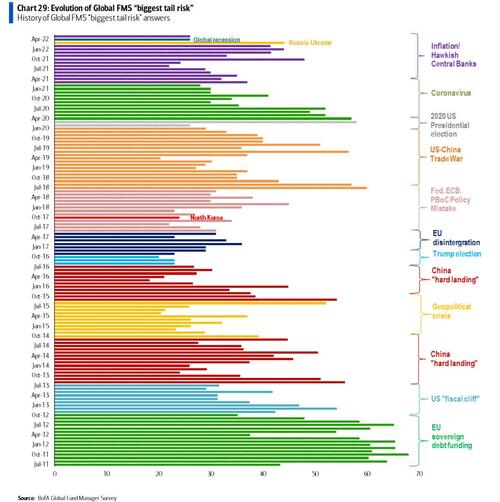

Turning to risk, the survey said that the #1 tail risk in May are hawkish central banks, followed closely by #2 recession; with risks from inflation and Russia/Ukraine dropping surprisingly to third.

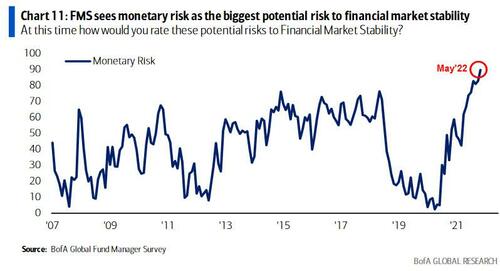

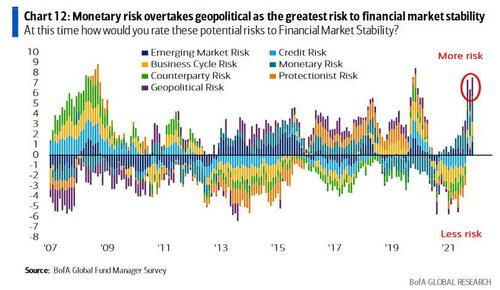

Overall, monetary (i.e, central bank) risk has overtaken geopolitical as the biggest risk to market stability, at net 52%, a record high...

... while geopolitical risk moves to the second biggest risk to financial market stability at net 87% (from 92%) followed by business cycle risk (75%) and EM risk (57%).

Broken down on a monthly basis, the chart of the global FMS biggest tail risk shows more of the same: fears that central banks will blow it all up.

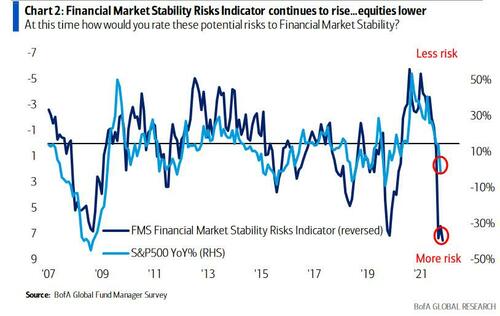

Hartnett next turns to his trademark Financial Market Stability Risk indicator, which continues to rise as stocks slide. According to the BofA CIO, "our FMS Financial Market Stability Risks Indicator is currently at 7.5, a record high. Elevated levels of risk aversion comparable to prior crisis moments (GFC, COVID shock). The high perceived risk to financial market stability also points to a further decline in equity prices This chart is the sum of the z-scores (from Chart 12) to create our FMS Financial Market Stability Risks Index."

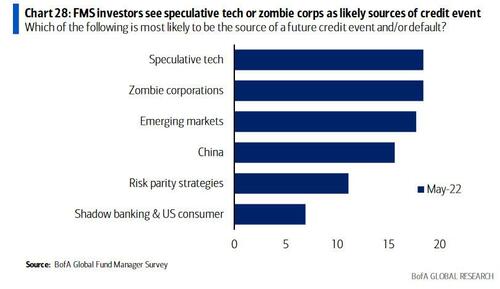

And speaking of what could spark a crash, the May FMS founds that speculative tech and zombie corporations are tied at 18% for the most likely source of a future credit event or default.

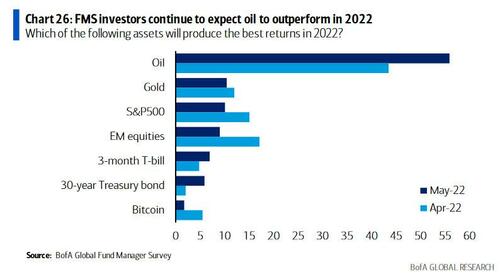

Some other notable questions in the FMS suggest that peak oil may be coming and that it is again time to rotate into bitcoin. Why? Because 56% of FMS investors think oil will produce the best returns in 2022 but only 2% think bitcoin will outperform. Expect the opposite.

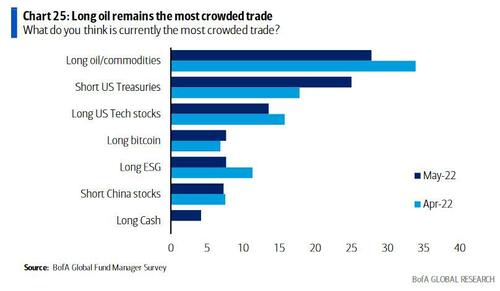

... especially since Long oil/commodities remains the most crowded trade.

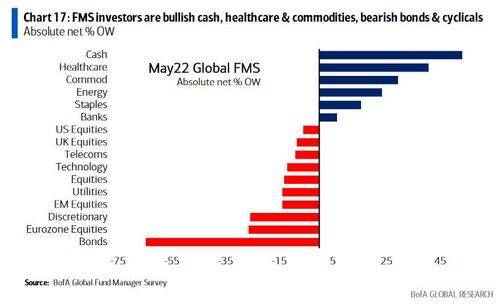

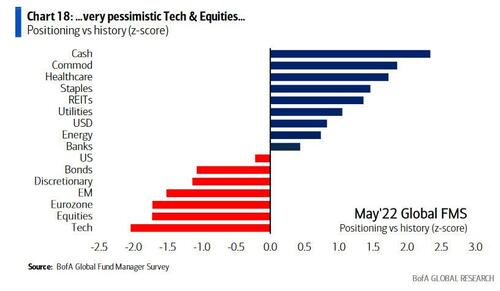

Looking at consensus positioning, Hartnett finds that investors are very long cash, commodities, healthcare, staples...

... and very short tech, equities, Europe, EM.

How to trade this? Go long what is underinvested and short what everyone is long, or do the opposite of the latest rotation where investors have gotten more defensive (i.e. staples, cash, healthcare) while at the same time cut exposure to tech, US, equities and

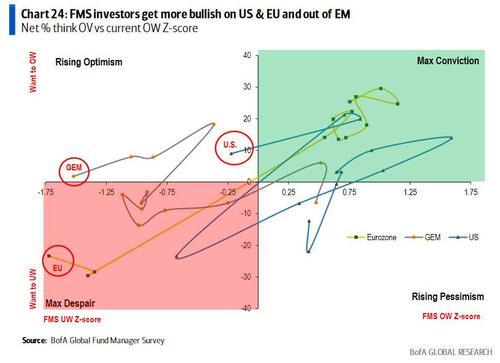

EM. To wit, since in May, FMS investors rotated out of tech, banks, and energy...

...while getting slightly less negative on EU. Investors also got more negative on US, UK, and EM equities, and are currently still underweight EM equities on a historical basis but want to increase their exposure as well in the next 12 months.

Ironically, that means going long tech since the allocation to tech is the lowest since Aug’06, and to defensives on par with GFC, Euro-crisis, COVID-crisis levels, while the allocation to stocks is lowest since May’20 (but not as low as prior crisis levels).

Finally, here are the contrarian trades recommended by Hartnett:

- to express H2 recession...long bonds-short commodities, long utilities-short energy;

- to express H2 soft landing...long EM/Europe-short cash, long tech- short healthcare, long discretionary-short staples

There is much more in the full fund manager survey available to professional subscribers at the usual place.

via IFTTT

InoreaderURL: SECONDARY LINK