"When Not If..." - Monster Of A Recession On Deck

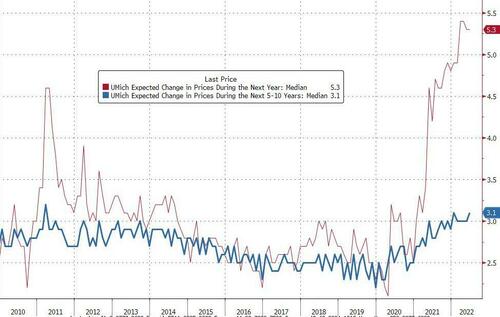

While everyone has been transfixed by the unexpected drop in the UMich 5/10 year inflation expectations, which dropped to 3.1% from a preliminary 3.3% print, which means that the alarm signal that prompted the Fed to panic last week and prompted the market to aggressively reprice (lower) the odds of future Fed hikes...

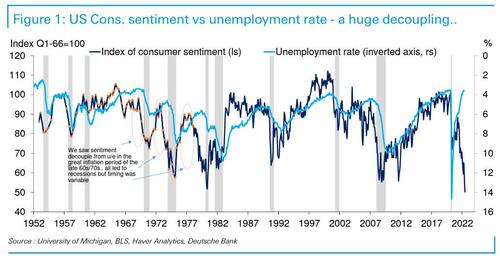

... the report also showed the lowest consumer sentiment reading in the 70-year history of the series, realistically speaking a far more troubling indicator than what a small group of respondents think inflation will be in 10 years (spoiler alert, it will be much higher than they expect).

So as Friday's Chart of the Day titled "When not if..." from Deutsche Bank's Jim Reid (excerpted from his latest chartbook, available to professional subs) shows, this is remarkable when the unemployment rate is so low. We have never seen such a divergence between the two series. The full survey shows that inflationary pressures are the main reason confidence is so low.

Eyeballing the chart, while sentiment is clearly more volatile than unemployment, the peaks in sentiment and lows in unemployment tend to broadly coincide. Reid circled the main occasions where sentiment has notably led unemployment and, interestingly, they were all between the late 1960s and the late 1970s when inflation structurally picked up. All of those situations led to a recession and a sharp turn higher in unemployment. Indeed, if sentiment is the leading indicator and if unempolyment is set to soar to 14%, we are about to have a monster recession on out hands.

As Reud concludes, "with unemployment currently so low it might still take a while for a recession to play out it’s almost certainly when not if. I would love to have a more optimistic message to deliver. If you have one please email me as I would be only too happy to be proved wrong and persuaded otherwise. Hopefully my mail box will be so full that I’ll be very bullish on the economy by Monday."

via IFTTT

InoreaderURL: SECONDARY LINK