IMF Slashes Global Growth Outlook, Blames Putin; Fears 'Social Unrest' & 'Global Instability'

Echoing The World Bank's pessimistic perspective from yesterday, The IMF has cut its growth forecasts, saying that global economic prospects have been severely set back, largely because of Russia’s invasion of Ukraine.

The war adds to the series of supply shocks that have struck the global economy in recent years. Like seismic waves, its effects will propagate far and wide - through commodity markets, trade, and financial linkages.

“In the matter of a few weeks, the world has yet again experienced a major, transformative shock,’’ IMF chief economist Pierre-Olivier Gourinchas wrote in the foreword to the fund’s World Economic Outlook report.

“Just as a durable recovery from the pandemic-induced global economic collapse appeared in sight, the war has created the very real prospect that a large part of the recent gains will be erased."

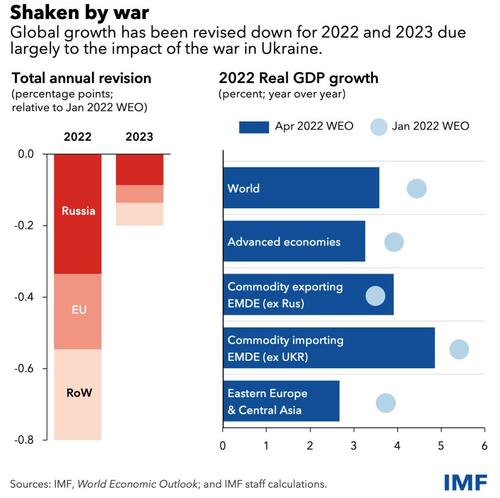

The IMF has revised its projection for global growth downwards to 3.6 percent in both 2022 and 2023 - a steep falloff from 6.1% last year and from the 4.4% growth it had expected for 2022 back in January. This reflects the direct impact of the war on Ukraine and sanctions on Russia, with both countries projected to experience steep contractions. This year’s growth outlook for the European Union has been revised downward by 1.1 percentage points due to the indirect effects of the war, making it the second largest contributor to the overall downward revision.

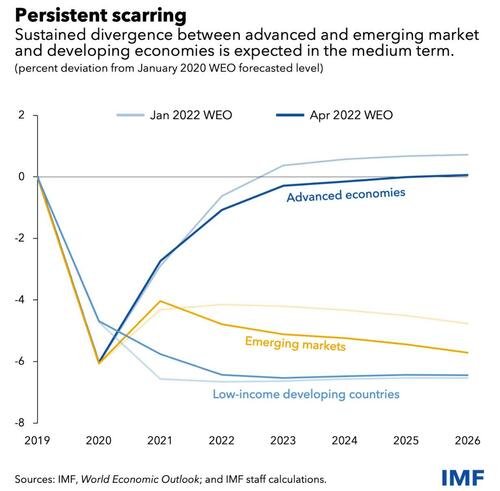

The detailed breakdown shows emerging and low-income countries will suffer the most...

And the divergence that opened up in 2021 between advanced and emerging market and developing economies is expected to persist, suggesting some permanent scarring from the pandemic.

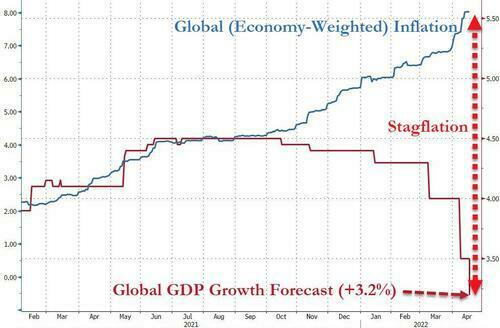

Inflation has become a clear and present danger for many countries. Even prior to the war, it surged on the back of soaring commodity prices and supply-demand imbalances. Many central banks, such as the Federal Reserve, had already moved toward tightening monetary policy. War-related disruptions amplify those pressures. The IMF now projects inflation will remain elevated for much longer.

The IMF - like The World Bank - blames Putin and raises concerns about inflation...

"The effects of the war will propagate far and wide, adding to price pressures and exacerbating significant policy challenges..."

...prompting the central planners' nemesis to re-appear leviathan-like to dominate the next few years...

As The IMF warns, the risk is rising that inflation expectations drift away from central bank inflation targets, prompting a more aggressive tightening response from policymakers. Furthermore, increases in food and fuel prices may also significantly increase the prospect of social unrest in poorer countries.

In a speech last week, IMF managing director Kristalina Georgieva warned of the threat of “more hunger, more poverty and more social unrest.’’

Particular attention should also be paid to the overall stability of the global economic order to make sure that the multilateral framework that has lifted hundreds of millions out of poverty is not dismantled.

via IFTTT

InoreaderURL: SECONDARY LINK