Illinois Pension Shortfall Surpasses $500 Billion, Average Debt Burden Now $110,000 Per Household

By Ted Dabrowski and John Klingner of Wirepoints (click here for a pdf of the report)

Illinois just reached an alarming milestone: each Illinois household is now on the hook for, on average, $110,000 in government-worker retirement debts. That figure is the result of dividing Illinois’ $530 billion in state and local retirement shortfalls among the state’s 4.9 million households. In 2019, the burden was $90,000 per household.

Illinois’ retirement debts increased to $530 billion in 2020, according to a Wirepoints analysis of Moody’s Investors Service debt estimates. This is the first year the credit rating agency’s estimates of Illinois’ retirement debts, made up of both pension and retiree health shortfalls at the state and local level, have broken $500 billion.

The jump in Illinois’ shortfall, up nearly $100 billion compared to 2019, was due largely to the drop in interest rates as a result of the COVID crisis. Illinois’ shortfall is expected to remain elevated in 2021 despite the market recovery. (See Appendix B.)

The growth in Illinois’ retirement debts to half-a-trillion dollars is yet another grim reminder of how lawmakers’ refusal to address the pension crisis does real harm to ordinary residents. These outsized debts have contributed directly to Illinois’ other crises, including the state’s worst-in-the-nation credit rating, the 2nd-highest property taxes and the nation’s 5th-worst decline in real home values.

The pension crisis has also contributed indirectly to a record rate of outmigration and the nation’s 2nd-largest population losses since 2010.

In addition, the growing debts point to just how much the retirement security of more than a million Illinois government workers and retirees has collapsed.

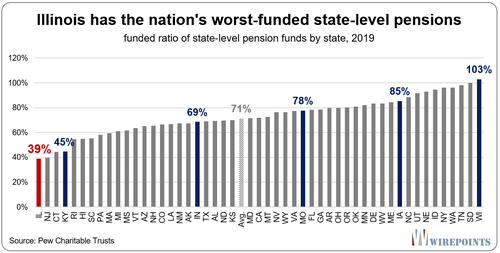

According to Pew Charitable Trusts, Illinois’ state-level pensions are just 39 percent funded, the lowest ratio in the nation.

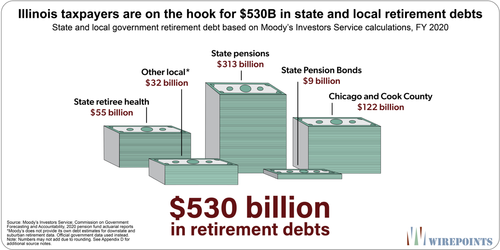

In all, Illinois’ $530 billion state and local retirement shortfall is made up of:

- Illinois’ five state-run pension funds – $313 billion

- State retiree health insurance – $55 billion

- State pension obligation bonds – $9 billion

- Chicago and Cook County pensions and retiree health – $122 billion

- Other local government pensions and retiree health – $32 billion

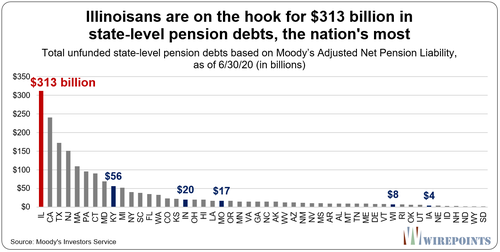

Illinois continues to be the nation’s extreme outlier when it comes to pension debts as measured by Moody’s. Comparing state-level pension data alone – there is no like-for-like comparison for all state and local retirement debts across the 50 states – shows Illinois’ debt swamps that of its neighbors and other big states.

At $313 billion, Illinois’ state-level pension debt is the nation’s biggest, the 2nd-most on a per household basis, and the highest when measured as a share of state revenues and GDP. Illinois also has the nation’s highest pension costs as a share of revenues, according to Moody’s.

Record debts, no matter the source

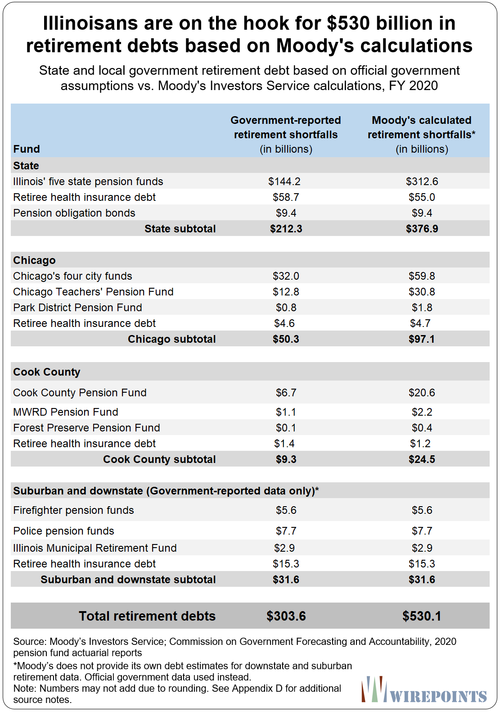

It’s important to note that Moody’s $530 billion calculation is much higher than the official government estimates of $303 billion for Illinois’ state and local retirement debts (don’t confuse this number with Moody’s state-level-only pension debt of $313 billion). Moody’s uses lower discount rates than the state to calculate the present value of what’s owed to retirees, resulting in far larger shortfalls. In contrast, Illinois governments use far more optimistic investment rate assumptions to arrive at lower debt numbers.

The full explanation of the difference between Moody’s and the official debt calculations is covered in Appendix A, but what readers should know is that Moody’s discount rates better reflect the guaranteed pension promises that governments make to public sector workers, which taxpayers are on the hook for.

Moody’s methodology is broadly in line with the opinions of financial experts ranging from Nobel prize winners like Stanford’s Prof. William F. Sharpe and University of Chicago’s Prof. Eugene Fama, to other academics including Hoover Fellow Joshua Rauh and the late actuary Jeremy Gold.

While Wirepoints uses Moody’s debt estimates as the standard in this report, we also report the state’s official numbers for comparison purposes. Illinois’ official calculations also reached a negative milestone of their own this year: state and local retirement debts crossed the $300 billion mark in 2020. Any way you cut the numbers, retirement debts are reaching record levels in Illinois.

Illinois’ per household debts are overwhelming

Most Illinoisans can’t comprehend the meaning of $530 billion in retirement debts, but they’re increasingly feeling the burden those debts create every day.

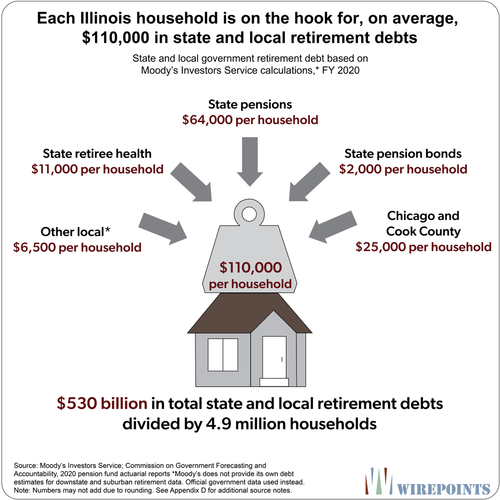

On average, each of Illinois’ 4.9 million households is on the hook for $110,000 in state and local shortfalls, based on Moody’s pension calculations ($530 billion spread over 4.9 million households).

That burden has consistently manifested itself in the higher taxes that residents have been paying, as well as in the reduced services they’ve been receiving. What’s worse, any taxes dedicated to paying down those debts over the next couple of decades won’t go toward new or improved services, but instead toward services already rendered. In other words, the future taxes needed to pay down that debt will be in addition to the taxes needed to pay for schools, transportation, healthcare and more.

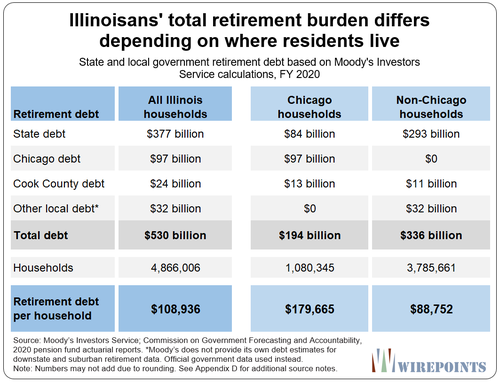

The $110,000 per household is an average across the entire state, but the precise burden for Illinoisans differs depending on where they live. The debt burden on Chicago’s one million households is larger because of the city’s deeper debt crisis. There, each household is on the hook for $180,000 for their share of state and local retirement debts.

Illinoisans living outside of Chicago, meanwhile, face an overall average burden of $90,000 per household. For comparison purposes, the burdens for Chicago and non-Chicago households, based on official state and local retirement debts, are $95,000 and $53,000, respectively.

Illinois the outlier

Illinois is the nation’s extreme outlier when it comes to retirement debts based on Moody’s calculations, particularly when just state-level pension debts are compared.

Illinois’ $313 billion shortfall in its five state-run pension funds, as of June 30, 2020, is the largest in the country, dwarfing that of its neighbors and other big states.

California, with more than triple the population of Illinois, has a state-level shortfall of $240 billion – $70 billion less than Illinois. And Texas, with more than double the population of Illinois, has a shortfall of $173 billion – $140 billion less than Illinois. Kentucky, suffering a pension crisis of its own, has a $56 billion state-level shortfall – just a fifth the size of Illinois’. The rest of Illinois’ neighbors have shortfalls valued at just $20 billion or less.

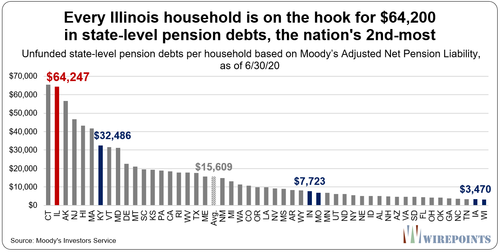

When measured on a per household basis, Illinois’ state-level pension debt totals more than $64,200. That’s the nation’s 2nd-largest burden, behind only Connecticut’s $65,400 per household. Illinoisans’ state-level household burden is four times larger than the national average of $15,600, and compared to residents in neighboring Iowa and Wisconsin, Illinoisans’ burdens are 18 to 20 times larger. Iowa and Wisconsin’s per household burdens are $3,500 and $3,200, respectively.

Please note the 50-state economic and financial comparisons for June 30, 2020 are not yet available from Moody’s. The following 50-state comparisons are based on state-level pension debts as of June 30, 2019. Illinois’ shortfall totaled $236 billion that year.

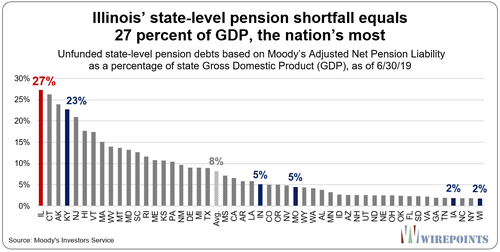

Illinois’ state-level pension debt also makes the state an extreme outlier when measured against other economic and financial metrics.

Illinois’ state level-debts are equivalent to 27 percent of the state’s annual GDP. In most of Illinois’ neighboring states, the debt is equal to just 2 to 6 percent of GDP. Indiana’s debt is at 5 percent, while Iowa and Wisconsin’s debt are both equal to less than 2 percent. Only Kentucky, which is struggling with a pension crisis of its own, comes close to Illinois with debts equal to 23 percent of GDP.

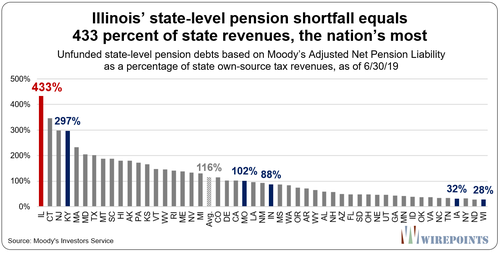

Illinois’ debts are also the nation’s-most when compared to state revenues. State-level pension debts are equal to 433 percent of Illinois’ own-source tax revenues, which is nearly four times the national average of 116 percent, and 15 times higher compared to Wisconsin’s 28 percent of revenues.

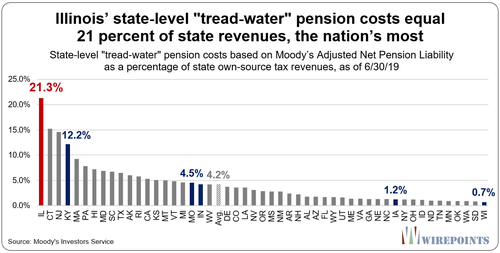

Illinois also has, by far, the highest pension costs as a percentage of state revenues. Moody’s says Illinois’ “tread water” pension cost – the annual state contribution required to ensure the state’s pension shortfall doesn’t grow from one year to the next – equals 21 percent of Illinois’ own-source tax revenues.

No other state comes close to that amount. Connecticut’s tread water cost equals 15 percent of revenues, the national average is just 4 percent, and all of Illinois’ neighbors’ costs, except Kentucky, equal just 5 percent or less of revenues.

Illinois is also the nation’s extreme outlier when it comes to retirement security for state workers. Illinois state-level pensions were only 39 percent funded in 2019, according to official data collected by the Pew Charitable Trusts. A funded ratio of 60 percent or below is often seen as a “point of no return” for pension funds.

In contrast, most of Illinois’ neighbors are far better funded. Indiana’s funded ratio is 69 percent, 30 percentage points higher than Illinois, Iowa’s is 85 percent, and Wisconsin has the healthiest pensions in the nation with a funding ratio of 103 percent.

The need for structural reform

Lawmakers have done nothing since their failed reform efforts in 2013 to try and stem the growth in Illinois’ debt. That year, a majority of Democratic lawmakers and Gov. Pat Quinn agreed that pension reform was essential to fixing the state’s dire financial problems.

Then-Attorney General Lisa Madigan cited the conclusions previously reached by the General Assembly when she defended the reforms in front of Illinois’ Supreme Court:

“Having considered other changes that would not involve changes to the retirement system, the General Assembly has determined that the fiscal problems facing the state and its retirement systems cannot be solved without making some changes to the structure of the retirement systems.”

Today, most politicians won’t even discuss the possibility of reform, while others declare reform a “fantasy.”

But the reasons for structural changes are even more valid today than they were in 2013. The situation for Illinoisans has only gotten worse: state-level pension debts alone have risen by more than 60 percent, hundreds of local public safety funds have fallen closer to insolvency, Illinois’ tax burden remains one of the nation’s highest, and the state’s credit rating was at the brink of junk just a few months ago.

The hard truth is that Illinois’ crisis will only worsen over time. As the state’s retirement debts continue to grow, more and more Illinoisans will be motivated to leave the state’s debts behind while fewer migrants will be willing to move in and assume the pension burden. A growing debt burden on an ever-shrinking population will only hasten Illinois’ downward spiral.

Pension reform is inevitable. The question is whether Illinois’ legislature will address the crisis now, while Illinois still has assets and dynamism left, or delay until this state is a shadow of its former self. It’s a question of whether those reforms will happen in a controlled, organized fashion, or under the duress of fiscal and political chaos. And it’s a question of whether lawmakers will enact true structural reforms or pass more can-kicks as they have in the past.

Wirepoints’ Pension Solutions

The first step towards any reform effort is acknowledging that Illinois has a problem. That’s the purpose of this report – to bring attention to an overwhelming crisis that’s being ignored. Only once that crisis has been recognized and properly diagnosed can real solutions be discussed.

That said, Wirepoints has developed a baseline reform plan that can help fix the pension crisis. For more information about Illinois’ pension crisis and how it can be solved, see Wirepoints’ Pension Solutions.

To view Wirepoints’ detailed, actuarially-scored baseline retirement restructuring plan, read Wirepoints’ Special Report: Solving Illinois’ Pension Problem: Why It’s Legal, Why It’s Necessary, and What It Looks Like.

For a breakdown of the state’s official debts and their trend over the past two decades, visit Wirepoints’ Illinois Pension Facts.

And for a deeper analysis of Illinois’ local pension crisis, see Wirepoints’ Special Report: Communities in crisis: More than half of Illinois cities get “F” grades for local pensions.

via IFTTT

InoreaderURL: SECONDARY LINK