Rent Is Becoming A Crisis In The U.S.

The growing rental crisis in the U.S. has shown no signs of stopping.

That was the topic of a new Bloomberg report this week that highlighted the stories of numerous Americans struggling to meet their rental obligations.

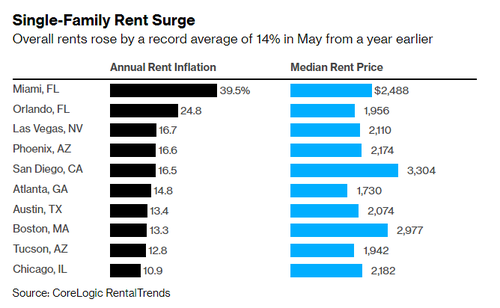

The cost of rent in the U.S. is moving higher at the highest pace in three decades, the report notes, blowing past a median of $2,000 per month for the first time ever. Rents are now above where they were prior to the pandemic in most major cities.

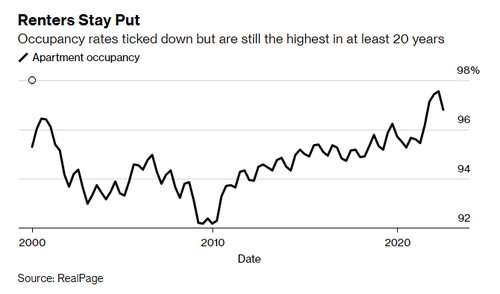

Areas just outside cities, which saw a large influx of new renters during the pandemic, have seen their rents rise disproportionately higher. People returning to large cities, post-pandemic, have also not helped prices cool off.

Additionally, rising interest rates have now deterred some would-be buyers, who are now becoming renters. Tight inventory continues to lead to bidding wars, even in the rental market, the report says.

Kate Reynolds, principal policy associate at the Washington-based Urban Institute, said: “It’s pretty much the perfect storm for renters right now. Those renters and their landlords don’t have a place to turn if they’re unable to pay the rent.”

At the same time, renters are trying to cope with the affects of inflation nearly everywhere else in their lives.

Bloomberg notes that people of color and those with lower incomes are most disproportiately affected by the rise in rents:

In the US, about 58% of households headed by Black adults rent their homes, along with nearly 52% of Latino-led households, according to a Pew Research Center analysis of census data. In comparison, about a quarter of households led by non-Hispanic White adults, and a little under 40% of Asian-led households, are rentals. Some 54% of renters earn less than $50,000, and the annual median household income among renters is about $42,500, below the national median of $67,500, according to Zillow.

Single family rents were up by a record 14% in May from the year prior this year. In some cities, like Miami and and Orlando, rents skyrocketed 40% and 25%, respectively. Las Vegas rents were up 16.7% in May from the year prior.

Cities like Atlanta have also seen rents rise 14.8% from a year prior. People moving from the West or the Northeast to the South have also boosted rents.

Duluth, Georgia resident Karla Kelley said: “We’re getting a lot of people from the Northeast or from the West Coast. To them, these rents are not huge.”

40% of all households that are not current on their rent say they are likely to be evicted or foreclosed within the next two months. This represents about 5.4 million households, according to the report.

And as we have documented on this site many times over, people are now turning to debt to try and cover their costs - including their housing costs. Credit card balances were up $46 billion in Q2 of this year and 30% of Americans have admitted to using credit cards or loans to meet "spending needs in the prior week". This number was up from 23% in early January.

via IFTTT

InoreaderURL: SECONDARY LINK