"The Market Is Softening, Full Stop": Zillow Plunges After Company Issues Dire Housing Outlook

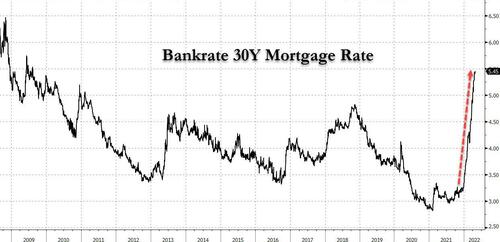

It's one thing for a fringe, tinfoil, conspiracy theory website such as this one to warn (repeatedly, for months) that with mortgage rates rapidly approaching 6%, the US housing market is on the verge of a vicious collapse, as discussed articles such as these:

- Housing Affordability Is About To Crash The Most On Record

- Cracks Appear In Housing Market As Sellers Begin To Lower Asking Prices

- Biggest Housing Affordability Shock In History Incoming

- Worst Ever US Home Affordability Is Just 0.5% Away

It's another for one of the biggest housing-market linked companies to confirm just that.

On Thursday, Zillow plunged as much as 13% in late trading Tuesday after a dismal outlook stoked investor fears that rising mortgage rates will spark the next crash in the US housing market.

The company, which last year suffered tremendous losses of more than $500 million in its home-flipping segment resulting in a record wrtide-down, projected that its internet, media and technology (IMT) segment will bring in $134 million to $169 million in EBITDA in the second quarter, according to a shareholder letter published Thursday.

While home sales usually pick up in the spring, Zillow’s outlook indicates that soaring mortgage rates and low inventory of for-sale homes will finally slow activity.

Zillow co-founder and CEO Rich Barton, played both good cop and bad cop, and in the company's press release issued a somewhat upbeat outlook: "while the housing market outlook may be choppy in the near term, today's first-quarter results, together with our strong brand, audience, and balance sheet, demonstrate how well-positioned and prepared Zillow is to forge ahead."

However, in an interview with Bloomberg, his takes was far less cheerful: “The market is softening, full stop,” Barton said, adding that the toughest macro lens is that inventory levels continue to plummet. Flat transactions would be a good year this year, and I don’t know if we’ll get there.”

As Bloomberg writes, Zillow's dire outlook caps a tumultuous period during which it shut down a foray into flipping homes and shifted its focus to a “housing super app” to integrate home tours, financing, seller services and the company’s partner network. Barton said that shuttering Zillow Offers had lightened his company’s balance sheet and left it in a better position to weather a slowing market.

“It's a great way to go into a headwind,” he said. “We can go into this headwind confidently, with our eyes focused on building out the super app.”

It wasn't all bad news: the (still) hot housing market in the first three months of 2022 boosted Zillow’s advertising business and helped speed efforts to wind down the home-flipping operation, called Zillow Offers. The company generated a total $220 million in adjusted Ebitda for the quarter. Analysts expected $156 million, the average in a Bloomberg-compiled survey.

In hopes of preventing a stock plunge, Zillow also authorized an additional $1 billion in share buybacks, but it wasn't meant to be and ZG tumbled more than 13% after hours.

via IFTTT

InoreaderURL: SECONDARY LINK