A Quarter Of All Personal Income In The US Comes From The Government Tyler Durden Fri, 08/28/2020 - 15:25

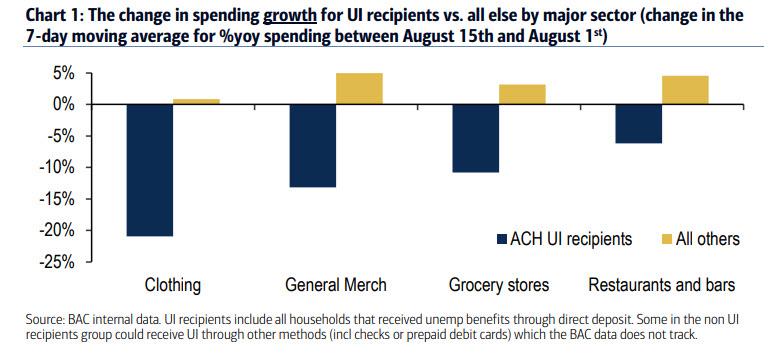

Today's release of the latest Personal Income and Spending data showed that income and spending both rose more than expected in July, just ahead of the fiscal cliff at the end of that month, which as we showed last week has resulted in a sharp drop in spending among recipients of Unemployment Benefits.

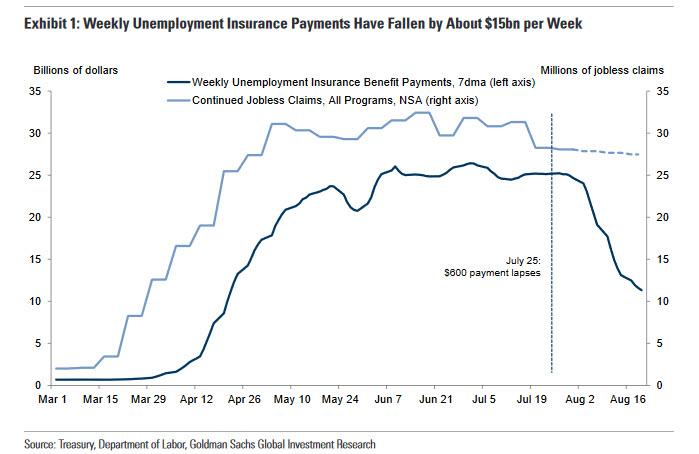

In other words, it is safe to say that with much of the unemployment insurance benefits on their way out, as the following chart from Goldman shows...

... spending will slide in August and onward unless a new fiscal stimulus program is agreed upon by Congress (for now, consensus among strategists is that for that to happen, the market will need to suffer a correction first).

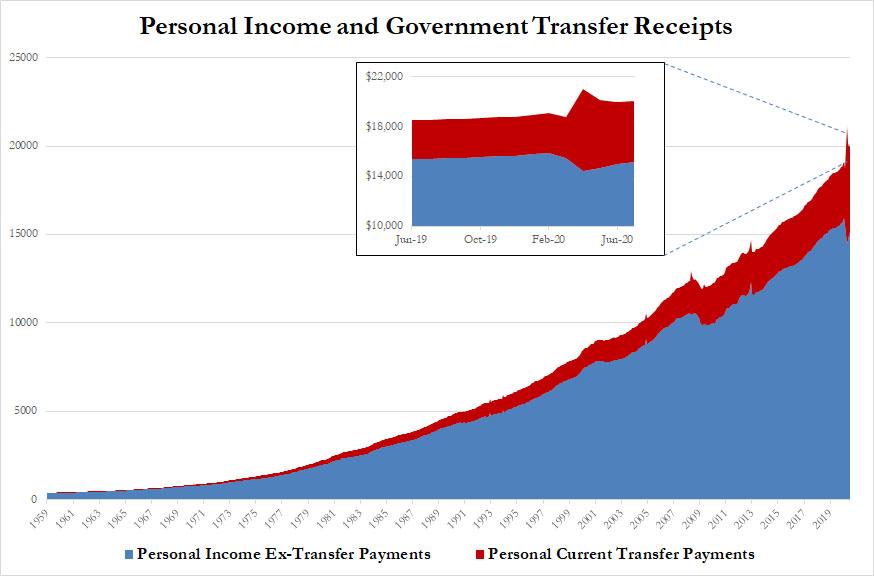

It is even safer to say that if all government stimulus were withdrawn, the US would stumble right into a double dip recession (if not depression), because as we have shown previously what was most remarkable about today's personal income and spending data is just how reliant on the US government the population has become.

We are referring, of course, to Personal Current Transfer payments which are essentially government sourced income such as unemployment and emergency benefits, welfare checks, and so on. In July, this number was $4.9 trillion annualized, just a small drop from the $5 trillion in July.

Just as striking, is that as of July when total Personal Income was just over $20 trillion annualized for the first time ever, the government is now responsible for just under a quarter of all income.

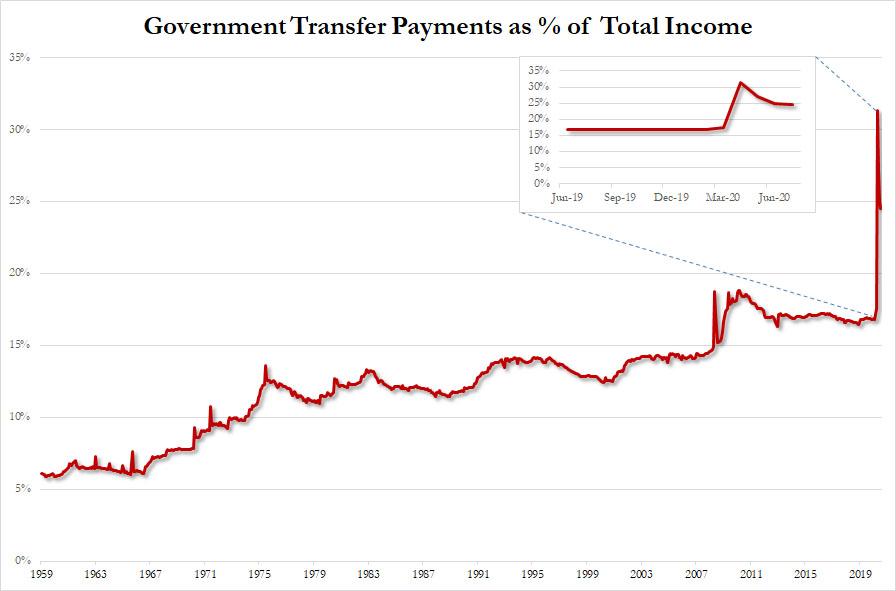

Putting that number in perspective, in the 1950s and 1960s, transfer payment were around 7%. This number rose in the low teens starting in the mid-1970s (or right after the Nixon Shock ended Bretton-Woods and closed the gold window). The number then jumped again after the financial crisis, spiking to the high teens.

And now, the coronavirus has officially sent this number into the mid-20% range, after hitting a record high 31% in April.

And that's how creeping banana republic socialism comes at you: first slowly, then fast.

So for all those who claim that the Fed is now (and has been for the past decade) subsidizing the 1%, that's true, but with every passing month, the government is also funding the daily life of an ever greater portion of America's poorest social segments.

Who ends up paying for both?

Why the middle class of course, where the dollar debasement on one side, and the insane debt accumulation on the other, mean that millions of Americans content to work 9-5, pay their taxes, and generally keep their mouth shut as others are burning everything down and tearing down statues, are now doomed.

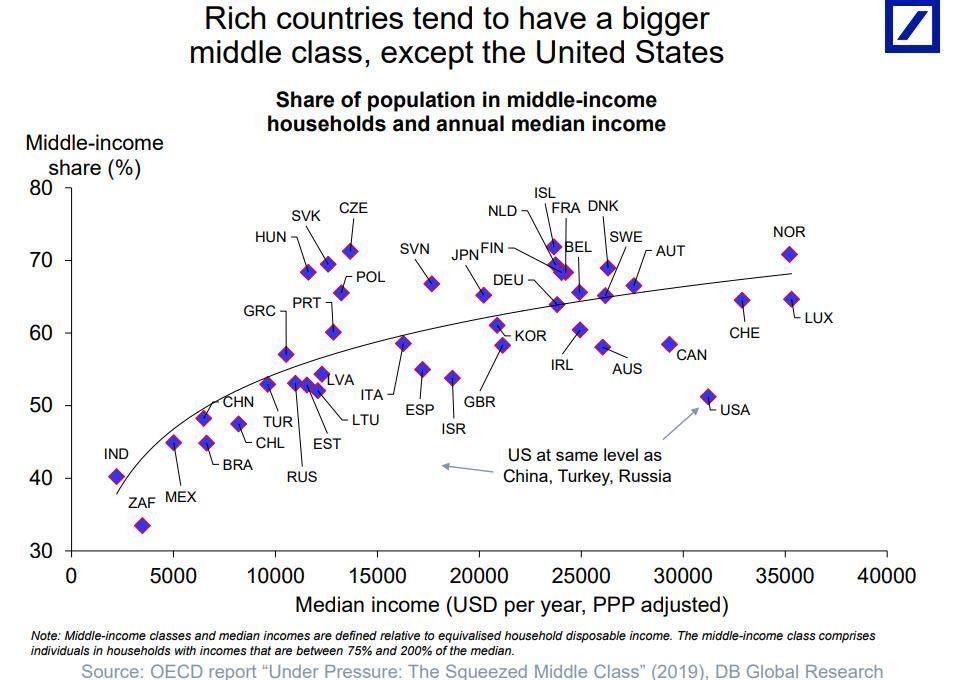

The "good" news? As we reported last November, the US middle class won't have to suffer this pain for much longer, because while the US has one one of the highest median incomes in the entire world, with only three countries boasting a higher income, it is who gets to collect this money that is the major problem, because as the chart also shows, with just a 50% share of the population in middle-income households, the US is now in the same category as such "banana republics" as Turkey, China and, drumroll, Russia.

What is just as stunning: according to the OECD, more than half of the countries in question have a more vibrant middle class than the US.

So the next time someone abuses the popular phrase "they hate us for our [fill in the blank]", perhaps it's time to counter that "they" may not "hate" us at all, but rather are making fun of what has slowly but surely become the world's biggest banana republic?

And as we concluded last year, and as even established banks now agree, "it has not Russia, nor China, nor any other enemy, foreign or domestic, to blame... except for one: the Federal Reserve Bank of the United States."

via IFTTT

InoreaderURL: SECONDARY LINK